High school students can benefit from learning how to budget their money as a valuable life skill for the rest of their lives.

School supplies and extracurricular activities are just two examples of the many costs high school students face. The typical high school student spends hundreds of dollars annually on just school supplies. When extracurricular activities, sports, and field trips are taken into account, this sum can easily double. According to Harvard University, the average annual cost of school supplies and associated fees for high school students is rising.

This lengthy list of expenses demonstrates the significance of budgeting for high school students, particularly for those with tight budgets and those putting money aside for college. High school students who are supporting themselves, as well as those whose parents pay for the majority of their expenses, will both benefit from learning how to budget their money.

For students pursuing ambitious academic goals, such as completing their high school education earlier through an online program, budgeting is also crucial. Students in high school can cover their expenses and get ready for college, where managing personal finances becomes a bigger responsibility, by learning how to create and manage a budget.

Ways to Create a budget for higher studies

It’s critical to consider both your current financial situation and your anticipated expenses when planning your study budget. When learning to manage your finances, establishing a budget while in college can help you understand where your money goes each month.

You can work toward bigger objectives like paying off student loan debt, traveling, and saving money for future milestones like moving to a new city after college if you have more clarity about your spending and saving habits. Even though your expenses may be lower while in college, now is a good time to start keeping track of your money. You will benefit from the budget you establish now throughout your 20s and beyond. Additionally, as your income and spending patterns change, you only need to make minor adjustments once the budget is established.

There are many ways to create a budget, including using an app that connects to your bank accounts or making a spreadsheet using an online template. Whatever strategy you decide on, keep in mind that you must follow through in order to be successful financially.

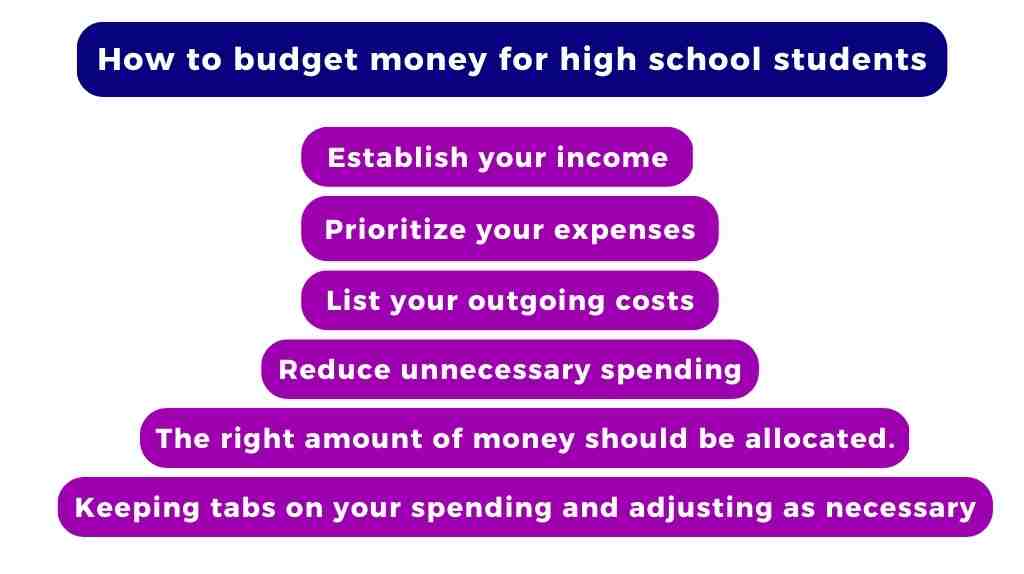

Following are some actions you can take to create a budget:

Establish your income: You might be working a part-time job or an internship during college to help pay for your education and cover living expenses. Additionally, you might receive money from loans, grants, scholarships, or your parents’ monthly allowance. Your monthly income is a crucial component of your budget because it establishes your financial limits and forms the basis for how much you can spend. Calculate your monthly income, taking into account any part-time employment, scholarships, or financial aid.

You must first determine your net income, which is the sum of money you receive after paying all taxes, before making a budget. Regardless of whether you work full- or part-time, if you receive a regular paycheck from your employer, the sum that is deposited into your checking account is your net income.

Try to determine an average amount that you can typically count on each month if you are an hourly worker whose hours vary from week to week and month to month. For the sake of avoiding overspending, it is better to choose a lower number.

List your outgoing costs: Make a list of all of your expenses, including tuition, books, lodging, travel, meals, and other incidentals.

Following are a few typical college-related costs:

- Rent or board and lodging

- Groceries

- domestic products

- School supplies (such as textbooks and electronics)

- access to a gym

- Debt payments (such as student, auto, and personal)

- Utilities (such as electricity, water, and gas)

And even though savings account deposits aren’t considered expenses, including savings, they can help you remember to set aside money for long-term objectives.

Prioritize your expenses: by ranking them in order of importance once you have totaled all of your outgoing costs. For instance, mandatory costs like tuition and books should come first, while optional costs like entertainment should come last.

It’s time to classify which expenses are fixed and which are variable after you’ve listed your monthly costs.

- Fixed expenses: these include things like textbooks, rent or room and board, groceries, transportation, insurance, and debt repayment that are typically unavoidable and must be paid.

- Variable costs: These are less fixed and frequently consist of wants like a gym membership, travel, dining out, and entertainment expenditures.

If your income decreased, you could always stop going to the gym, postpone your trip, or spend less on takeout. But you’ll probably always be responsible for things like travel costs, insurance, and rent or room and board.

Reduce unnecessary spending: Look for ways to lower costs associated with activities like dining out or shopping for new clothing. Take into account renting a room from a roommate, purchasing used textbooks, or taking the bus or the train instead of buying a car.

The right amount of money should be allocated: after figuring out your income and expenses, make sure you set aside enough money for tuition and other necessities while also having some money saved up for last-minute expenses or emergencies.

Keeping tabs on your spending and adjusting as necessary: It’s critical to track your spending frequently to make sure you’re staying within your budget. To monitor your spending and make necessary budget adjustments, use a spreadsheet or budgeting app.

Making sure the numbers add up requires comparing all the data you gathered during the budgeting process. Check to see if you have enough money coming in each month to cover all of your costs by looking at your net income in relation to your monthly expenses.

It’s time to make changes if you can’t afford your current way of life. In addition to thinking about ways to increase your income, such as working more hours, you should also consider ways to reduce your expenses.

This could entail lowering the amount of money you spend on varying costs, like limiting takeout orders and canceling streaming services you don’t use frequently. Some fixed expenses with variable costs may also need to be adjusted. To save more money when you shop for groceries, digital clip coupons ahead of time and choose store brands over name-brand products. Locate a rental apartment that is less expensive if you plan to move.

Advantages of budgeting

A crucial life skill for high school students is budgeting. It teaches them how to handle their money while attending school and instills responsible spending habits that will help them in college and beyond. Students can pursue a variety of opportunities after they graduate from high school, such as getting their first apartment, purchasing a new car, or paying for their first year of college tuition by building credit and saving money during that time. Students who have experience setting up and adhering to budgets have an advantage over those who are just beginning to learn how to manage their finances.

In order to balance their work schedules and maintain their financial stability while continuing their education, students who are already financially independent may find that taking their classes online gives them the flexibility they need.

All high school students can become financially responsible, establish specific future goals, and keep a balanced budget by learning how to manage their money while still in school.

Disadvantages of budgeting

Budgeting can be a useful tool for managing finances and achieving financial goals, but it also has several limitations.

Creating and monitoring a budget can be time-consuming, particularly if it requires detailed tracking of expenses and income. This can be a disadvantage for individuals who have a busy schedule. A budget is based on an assumption about future income and expenses, which may not always be accurate. If circumstances change, such as unexpected expenses, or changes in income, the budget needs to be revised. This can be difficult if the budget is inflexible or too rigidly structured.

Setting and adhering to a budget can be stressful, particularly if it requires significant changes in spending habits. This can be a disadvantage for an individual whose monthly income changes regularly. A budget is effective if it is followed, and some people may struggle to stay accountable to their budget goals, leading to financial instability.

Some budgeting methods that you should try

The 70 20 10 rule budget

This rule categorizes the percentage in the following ways:

- 70% for essentials

- 20% for financial savings

- 10% for entertainment and other costs

Using the 70 20 10 rule is a great way to start handling your money and achieving your financial goals. You can distribute your income in a way that works for you by getting your expenses under control. Of course, each person’s financial situation is different, so you should adjust the percentage to fit your own needs. By following this guideline, you can work to achieve long-term success and financial security.

The 50 30 20 rule budget

This is the most preferred rule for high school students. We categorize this into the following three groups:

- 50% for essential expenses

- 30% for wants

- 20% for savings

The 50 30 20 rule of budgeting is a great way to start taking charge of your finances, but it may require some lifestyle and spending habit adjustments.

The 80 20 rule budget

In this case, you are only allowed to spend 80% of your income, with 20% going toward savings. This method enables you to prioritize saving and is simple and adaptable.

- 80% for all expenses

- 20% for savings

By focusing on the 20% of your budget that covers 80% of your expenses, you can reach your financial goals.

The 60 20 20 rule budget

The 60/20/20 rule makes budgeting very easy and flexible. It provides a detailed framework for managing your money. By dividing your finances into three categories, you can quickly see where your money is going and make any necessary corrections. The three groups comprise

- 60% for essentials

- 20% toward saving

- 20% towards the financial goal

By following this rule, you can establish a solid financial foundation, order your financial goals in order of importance, and live a fulfilling life without going over your spending limit.

The 60 40 rule budget

An excellent tool for achieving financial balance is a budget based on the 60-40 rule. However, it requires dedication and self-control, just like any other budgeting strategy. Two categories can be found in this technique:

- 60% for fixed expenses

- 40% for variable expenses

If you exercise restraint and remain committed to your spending plan, you’ll be well on your way to financial success.

The 30 30 30 10 rule budget

The 30 30 30 10 rule budget is a straightforward budgeting technique that assists people in dividing their income into four categories, which are as follows:

- 30% for needs

- 30% for wants

- 30% for savings

- 10% for investing

Remember that it might take some time to find the best budgeting approach for you.

Visit us here for more information on budgeting advice.

Conclusion

Recall that maintaining a budget calls for commitment and discipline. You’ll be well on your way to meeting your financial objectives while you’re a student if you stick to your budget and refrain from overspending.

The time between high school and college is a great time to start saving because students are starting to work and earn money, but they are not yet financially responsible for many adult-related expenses. Students in high school can set objectives like buying a car, taking a trip, or paying for college to motivate their savings.

To build savings and improve financial literacy, you must have a savings account. Consider making a budget, including regular savings account deposits, and setting aside money for an emergency fund. Consider using a personal finance app to help make money management a little bit simpler, such as a budgeting or money-saving app.

Establishing sound money management techniques in high school is highly recommended. Students who want to switch to online high school should take the time to look into payment plans that offer reasonable monthly payments and low-interest rates so they can graduate without having to put too much strain on their finances. Students can balance their studies with other commitments, like work, by enrolling in an educational program that gives them the freedom to move at their own pace, like one that is offered online. Learn how specific courses can assist high school students in achieving their educational objectives while fostering financial independence.

FAQs

The easiest and most recommended rule is the 50-30-20 rule, which states that you should allocate 50% of your income for necessities (mortgage, food, transportation, and bills), 30% for wants (entertainment, dining out, travel, and shopping), and 20% for investments, savings, and debt repayment.

According to National Center for Education Statistics, in 2018–19, the US spent $800 billion (or $800 billion in constant 2020–21 dollars) on public elementary and secondary schools. 1 This comes to $15,621 per student enrolled in a public school that falls. Current expenses made up $13,701, or 88 percent of the $15,621 in total expenditures per student in 2018–19 nationwide. Salaries, benefits for employees, paid services, tuition, supplies, and other expenses are all considered current costs. $1,499 in capital expenditures were also included in the total costs per student.

The most preferred rule for high school students is 50 30 20 budgeting rule. You should divide your income into three different spending categories: needs and wants (50%) and, discretionary spending (20%), savings and investments (20%), according to the 50-30-20 rule.

The range for a student living on campus should be between $35 and $75 per week, according to the hundreds of parents who did send their college students spending money. The most typical response was $70 per week or $280 per month. In comparison to those without cars, students who had cars on campus needed more.

This post was truly remarkable, especially because I was looking for thoughts on this issue last Thursday.

Thank you so much for your kind words! I’m thrilled to hear that my post was helpful to you, especially since you were actively seeking information on this topic. It has always been my goal as a blogger to provide valuable insight and perspective that can make a difference in people’s lives. I hope you continue to find my content useful in the future, and if there’s any other topic you’d like me to write about, please don’t hesitate to get in touch!