Do you feel frustrated at the month’s end while considering money into an account? Also, do you know where all your money has gone? Well, you don’t need to worry anymore. I consider that you might have come across a word called “budget.” Yes, the budget. Now that you understand what a “budget” is and how to strictly apply it to your life, you can take control of your income and expenses.

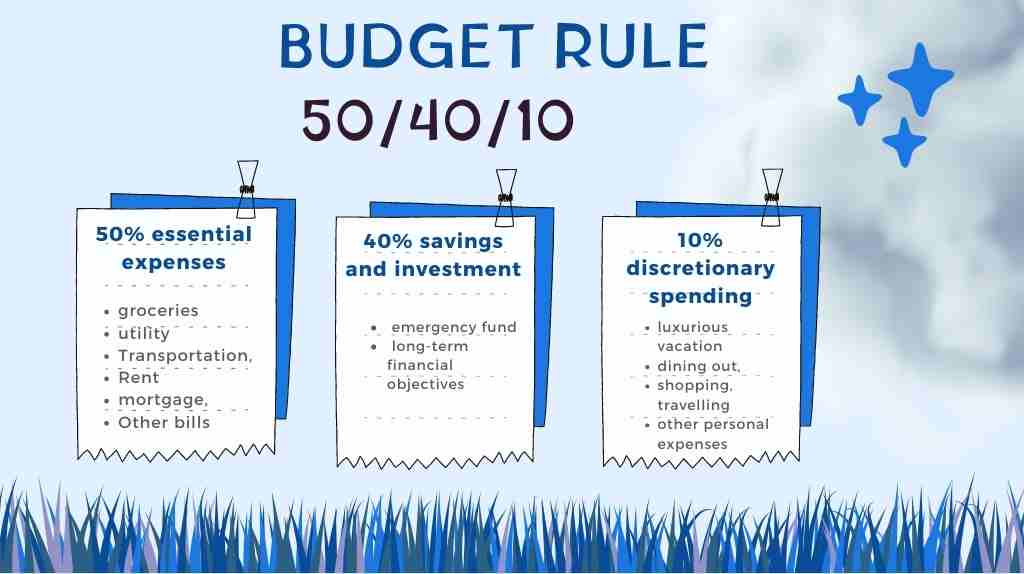

To create a budget plan, there are a few different ways to divide your income into a range of acceptable percentages. One of these well-liked budgeting techniques is known as “the 50 40 10 rule,” which you can implement in your life to achieve financial stability.

The process of creating a budget doesn’t have to be difficult or take up a lot of your time. In actuality, the simplest budgeting techniques are frequently the best.

Before you begin using the 50 40 10 rule budget, let’s discuss how budgeting functions, how to use it in daily life, and the function of fiscal rules in budgeting.

How to make categories in this budgeting rule

A popular budgeting technique known as the 50-40-10 rule can assist you in allocating your income in a way that guarantees you have enough money to cover all of your expenses while also setting aside money for the future.

50% towards essential expenses:

The largest portion of your income will be used to cover essential expenses. These are all the costs that you cannot avoid or that would make it difficult for you to survive without.

You can live without a subscription to an entertainment service, but not without paying your water bill, so it’s again important to be accurate, like maintaining regular payments for groceries, utilities, transportation, rent or a mortgage, and other bills. It is advised that you keep your spending to no more than 50% of your post-tax income.

Your savings and investment expenses will total 40% of your income:

which includes all of your savings objectives, such as setting up an emergency fund and other long-term financial objectives. As a minimum, you should try to save 40% of your monthly after-tax income.

10% for discretionary spending:

this category includes costs that are not necessities but that you enjoy and choose to spend money on, such as taking a luxurious vacation, dining out, shopping, traveling, and other personal expenses. You may designate up to 10% of your post-tax income to this category.

You don’t have much money to spend on wants, but the 10% you do spend in this category is necessary for you to live a little because life is meant to be lived.

How does the “50-40-10 rule” work? (with examples )

The examples below show how to apply the 50 40 10 rule.

Let’s assume that you make $5,000 per month after taxes. You would divide your income according to the 50-40-10 rule as follows:

50% for essential costs: which is $ 2500 of your after-tax income

40% for savings & investment: which is $2000 of your after-tax income

10% for discretionary expenses: which is $500 of your after-tax income

50 40 10 budget Calculator

| Expenses/Spending | Amount |

|---|---|

| Essential Expenses (50%) | $0.00 |

| Savings (40%) | $0.00 |

| Discretionary Spending (10%) | $0.00 |

Implementing the 50 40 10 rule budget in your life

Let’s get right to the implementation of this rule in our lives so that we can gain control over our finances and lead stable lives.

Step. 1: Determining After-Tax Income – The first step in the process is to determine your after-tax income, which is the total of your earnings after taxes. It might be as easy as looking at your paycheck to determine your take-home pay if you work as an employee. But if you work as an independent contractor or own a business, figuring out your take-home pay might be more difficult.

Step. 2: determining the expenses that you need to make – This step can be difficult if you’ve never created or used a budget. Consider the costs you’ve racked up over the last few months or years as you take your time. Consider reducing some of the expenses if you don’t think they’re necessary.

Make sure to keep notes on everything, including mortgage payments, dining out, student loans, groceries, and travel, to stay organized and better understand what needs to be done. The spreadsheet could be an Excel sheet or one that you print off the internet.

Step. 3: Make categories in the ratio 50 40 10 – Once you have a list of your essential expenses and your financial savings goal. Again, try to be as specific as possible to get a better idea of your expenses.

Taking care of daily costs

In order to maintain a comfortable standard of living, you must pay these expenses each month. There may be some research involved in creating a lifestyle that fits within 50% of your income. Give yourself 50% of your income to spend on necessities like groceries, utilities, rent or a mortgage, and transportation.

Creating a financial objective

Before you begin any course of action, take some time to decide on financial objectives that are consistent with your future. There is no point in budgeting if you don’t have the motivation to continue and achieve your initial goals.

Once you’ve determined your take-home pay, it’s time to set aside 40% of your income for future objectives. This is the amount you should be saving each month for retirement, unexpected expenses, and other long-term goals.

Spending on things you want

Just 10% of your income should be used for wants. They include pastimes that you enjoy but may not necessarily need, such as going out to eat, watching movies, shopping, participating in hobbies, and traveling.

However, if you are conscious of your spending limits, you might also want to spend money on a new wardrobe or go on a lavish vacation. Treating yourself to the things you cherish is also imperative.

Step. 4: Utilizing budgeting tools and adjusting spending as necessary constitutes- Budgets can be challenging to follow, so you can use spreadsheets, apps, or online tools to monitor your spending and review your budget each month.

After you’ve made a budget, monitor your spending and make the necessary adjustments. If you notice that you are going overboard in one category, try to cut back on another to maintain the 50-40-10 balance.

A simple and useful method for managing your money and reaching your financial goals is the 50-40-10 budget rule. These steps will enable you to begin using this method of budgeting and will help you achieve greater monetary stability and mental peace.

It might take you a few months to get it right, but if you overspent in one category at the end of the month, you could make up for it the following month. However, if you find that over time you are still having trouble adhering to the 50 40 10 rule, you may need to find a different percentage budget.

Will the 50 40 10 rule work for me?

The 50 40 10 rule is a tempting choice for anyone who wants to improve their financial situation. It’s important to keep in mind that the 50-40-10 rule is only a guideline and may not apply to everyone’s specific financial situation. It’s not for everyone because saving half of your paycheck requires a lot of dedication.

Before you begin, pause for a moment to think about your current income. If your income is low, this plan might at first seem excessive. However, anyone can create a budgeting plan. If you find that you can’t afford to cover your daily costs without going overboard with your wants, this budget might not be the best choice for you.

There are obviously a lot of other percentage budgeting strategies you can try if you need to start saving right away. In the end, what is most important is to create a budget that works for you and your financial situation, review it frequently, and make any necessary adjustments to it to make sure you are achieving your financial goals.

Advantages & disadvantages of the 50 40 10 rule budget

The 50-40-10 rule is a budgeting strategy that advises allocating 50% of your income to necessities, 40% to savings or investments, and the final 10% to discretionary expenses. Here are a few benefits and drawbacks of this budgeting approach.

Advantages

Simple and easy to follow: The 50-40-10 rule is a straightforward and simple budgeting approach that anyone can use. It offers a precise breakdown of how much money ought to be set aside for savings, discretionary spending, and necessities.

Prioritizes expenses: The rule does this by dividing up a set portion of your income among various categories. This will enable you to stay on track and limit your spending.

Encourages saving: By setting aside 40% of your income for savings, this budgeting strategy aids in the development of your emergency savings.

Disadvantages

Not for everyone: People with low incomes or high debt levels may find the 50-40-10 rule budget unsuitable. To allocate 50% of income to needs and 40% to wants may be challenging in these circumstances.

Ignores unique situations: This approach to budgeting works under the premise that everyone has similar wants, needs, and financial goals. It’s possible that not everyone will experience this, though.

Limited flexibility: It’s possible that the fixed percentages allotted to each category aren’t adaptable enough to account for fluctuations in income and expenses. As a result, it might be challenging to change the budget as circumstances arise.

Alternative budgeting methods

The 70 20 10 rule budget

This rule classifies the percentage into the following categories:

- 70% for necessities

- 20% for savings

- 10% for leisure/miscellaneous expenses

By following the 70 20 10 rule, you can start managing your money and achieving your financial goals. You can distribute your income in a way that is beneficial to you by organizing your expenses. It goes without saying that every person’s financial situation is different, so you should adjust the percentage to fit your specific needs. Following this rule will help you work toward long-term success and financial security.

Budget according to the 60-30-10 rule:

According to this budgeting advice, you should divide your income into three categories.

- You must set aside 60% of your income for necessities like utilities, food, transportation, and other necessary bills.

- Spending discretionary money on things like a fancy vacation, shopping, fine dining, etc., should not exceed 30% of your income.

- Your savings and investment accounts should set aside 10% of your income.

By adhering to this guideline, you can make sure that you are prioritizing your spending, taking care of your essential needs, and still having some flexibility and room for future savings.

It is important to remember that this rule is only a suggestion and may not be applicable to all situations. Every time you evaluate your personal financial situation, you should adjust your budget accordingly.

The 60 40 rule budget

A budget based on the 60-40 rule is a powerful tool for achieving financial balance. However, just like any other budgeting strategy, it calls for dedication and self-control. This method is divided into two categories:

- 60% for fixed expenses

- 40% for variable expenses

If you maintain your self-control and commitment to your budget, you’ll be well on your way to financial success.

The 30 30 30 10 rule budget

A simple budgeting method called the 30 30 30 10 rule helps people divide their income into the following four categories:

- 30% for needs

- 30% for wants

- 30% for savings

- 10% for investing

Remember that it might take some time to find the best budgeting approach for you.

The 80 20 rule budget

In this case, you are only allowed to spend 80% of your income, with 20% going toward savings. This approach is easy to use, flexible and allows you to prioritize saving.

- 80% for all expenses

- 20% for savings

Concentrating on the 20% of your budget that represents 80% of your expenses will help you reach your financial goals.

The 60 20 20 rule budget

The 60/20/20 rule is a very flexible and easy way to budget. It offers a detailed plan for managing your money. By dividing your finances into three categories and making any necessary corrections, you can quickly see where your money is going. The three categories include

- 60% for essentials

- 20% toward saving

- 20% towards the financial goal

By following this rule, you can establish a solid financial foundation, order your financial goals in order of importance, and live a fulfilling life without going over your spending limit.

Conclusion

In conclusion, using the 50 40 10 rule is an easy and efficient way to manage your money. By following this rule, you can organize your spending better, save money more wisely, and reach your financial objectives. The 50 40 10 rule is ideal for you if you need a budget where half of your income covers your needs and the majority of the other half goes to savings and investments.

You can always try to reduce some of your spending, and you might need to lower some of your essential monthly payments to prevent going over your budget. Regardless of your viewpoint, you won’t know if the 50-40-10 rule budget actually works until you give it a try. You’ll experience the advantages for yourself if you try incorporating this rule into your budgeting plan.

FAQs

The 50-30-20 rule can be a helpful starting point for developing a budget, but whether it is wise for you to use it depends on your financial situation and goals.

The 50-30-20 rule is a personal finance maxim that recommends allocating your income into three categories: needs (50%) and wants (30%), discretionary spending (20%), and savings and investments (20%).

The 50-30-20 rule, which states that you should set aside 50% of your income for necessities (mortgage, food, transportation, and bills), 30% for wants (entertainment, dining out, travel, and shopping), and 20% for investments, savings, and debt repayment, is the simplest and most effective guideline.

The 80 10 10 rule of finance is a budgeting method for setting future financial goals. By allocating 80% of your income to necessities, 10% to long-term savings and retirement, and the remaining 10% to debt repayment, the budgeting principle known as finance suggests that you allocate your income in a particular way.