Making a budget for your new household is one of the first things you should do after getting married. The 10-10-80 budget is a popular choice among couples who want to start saving for the future right away, even though it may not be the best strategy for every couple.

The foundation of the 10-10-80 budget is the idea that a household can comfortably live on no more than 80% of its income. Couples who follow this spending strategy set aside 80% of their combined income for essentials like food, utilities, rent, clothing, and other necessities. The remaining 20% is split between the couple’s savings and investments, with 10% going to charity.

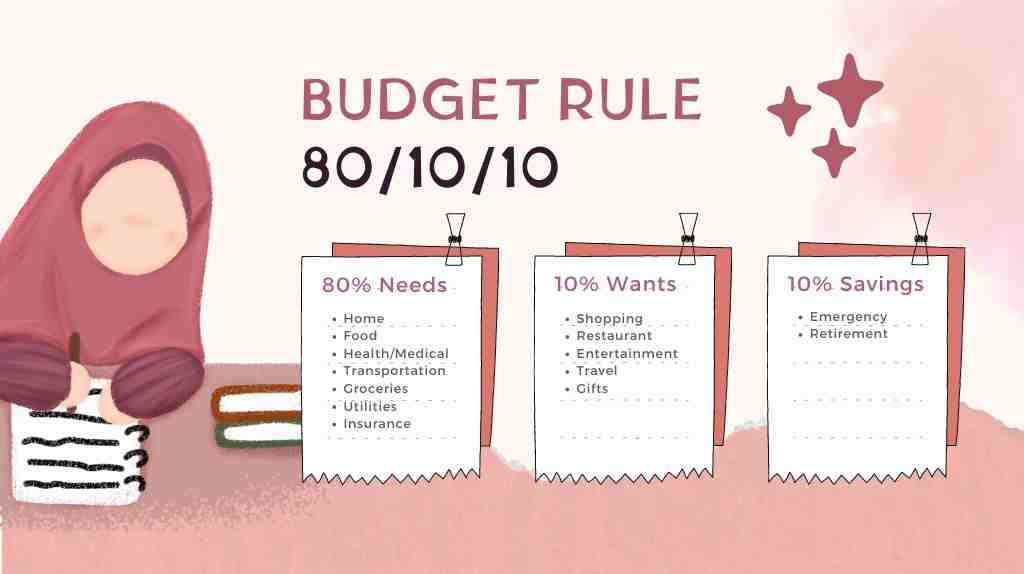

The 80 10 10 rule budget is explained in detail.

A straightforward yet effective budgeting strategy is the 80/10/10 rule, which divides your income into three main categories: essential expenses (which should account for 80% of your income), savings (10%), and discretionary spending (10%). Let’s take a closer look at each of the categories:

The costs of necessities (80%)

Your first category of income is for necessities. These are the costs you simply cannot avoid, such as rent or mortgage payments, utilities (such as gas, electricity, and water), groceries, travel expenses, insurance premiums, and other debts. In order to prioritize your needs and make sure you have enough money to cover your necessary expenses, it is recommended that you set aside 80% of your income for these costs.

You must add up all of your monthly bills, including rent or mortgage, utilities, insurance, travel expenses, and other necessities, to come up with your essential expenses. Then you can use this sum to determine what 80% of your income should be, and you can modify your spending as necessary.

Savings (10%)

Savings are the focus of the second category. This covers any money set aside for long-term objectives, like retirement, a down payment for a home, or an emergency fund. It’s recommended that you put saving first and designate 10% of your income to this category before you spend any money on luxuries.

To create a budget for your savings, you’ll need to decide what your financial goals are and how much you need to save each month from reaching them. Before creating a budget for your savings, you must determine your financial goals and how much you must set aside each month to meet them. You can set aside 10% of your income for this objective and modify your spending accordingly.

Discretionary spending (10%)

Spending discretion is the last category. This covers any non-essential costs, such as taking a deluxe vacation, dining out, entertainment, shopping, and hobbies. The concept is that after paying for your necessities and setting aside money for your financial objectives, you can use 10% of your income to reward yourself with things that make you happy and enhance your quality of life.

You must choose the activities or things you want to purchase and set aside 10% of your income for these costs in order to create a budget for your discretionary spending. To stay on track with your spending plan, you can make the necessary adjustments.

An illustration will help illustrate this: If you have a monthly income of $10,000 after taxes, the following would be your 80/10/10 budget: Amount allotted for living costs: $8,000. Budgeted for investments or savings accounts is $1,000. An amount of $1000 is set aside for donations to charities and other nonprofits, including churches.

You can make additional divisions for rent, utilities, food, transportation, entertainment, and any other regular monthly expenses you have within the living expenses section of your budget. For instance, you might set aside $4,000 for rent and utilities, $1400 for food, $800 for travel, $400 for entertainment, $200 for health care costs, and the remaining $1200 for other expenses.

80 10 10 Budgeting Calculator

Advantages & disadvantages of the 80 10 10 rule budget

Advantages

- 1. Ease of understanding and application: The 80 10 10 rule is a straightforward and simple budgeting technique.

- 2. Flexibility: As long as you stick to the general framework of allocating 80% to living expenses, 10% to savings, and 10% to discretionary spending, the 80/10/10 rule is adaptable enough to accommodate different income levels and lifestyles.

- 3. Financial security: The 80 10 10 rule promotes the creation of an emergency fund and long-term savings, which can bring about financial security and stability.

- 4. Automatic savings: By setting aside 10% of your income for savings, you train yourself to save money without having to think about it.

- 5. Maintain control over your savings: The 80/10/10 rule offers a framework for management and prevents you from overspending on discretionary items.

Disadvantages

- Ignores unique circumstances: because everyone’s financial situation is different. Everyone may not be able to follow the 80/10/10 rule, especially those with high expenses and low income.

- 2. Can be challenging to follow: Following any budgeting strategy, including the 80-10-10 rule, can be difficult. Maintaining a budget that caps your discretionary spending at just 10% of your income can be challenging.

- Does not take into account unforeseen costs: since life is unpredictable, unforeseen costs have the potential to ruin any budget. Unexpected expenses, which can be stressful and challenging to manage, are not well-served by the 80/10/10 rule.

- The long-term viability of the 80-10-10 rule may not be guaranteed: depending on your income. You may need to adjust your budget if you are living paycheck to paycheck to include more money for savings or debt repayment.

Is the 80/10/10 rule the best budget for me?

Anyone who wants to improve their financial situation may find the 80 10 10 rule to be an appealing option. It’s crucial to remember that the 80-10-10 rule is only intended to serve as a general guideline and might not be appropriate for every individual’s particular financial situation.

Think about your current income for a moment before you start. This plan may initially seem overly generous if your income is low. A budgeting plan, though, can be made by anyone. This budget might not be the best option for you if you discover that you cannot afford to save for your future financial goals without going overboard with your wants.

It goes without saying that there are a ton of other percentage budgeting techniques you can test out if you need to start saving right away. Create a budget that works for you and your financial situation, review it frequently, and make any necessary adjustments to it to ensure you are reaching your financial goals. This is ultimately what is most crucial.

How to get started with 80 10 10 rule budget?

You might be wondering who would prosper under the 80 10 10 rule after seeing the percentages. If you want to use the 80-10-10 rule budget to help you reach your financial objectives, getting started with it is very simple.

Here is how to create a budget using the 80-10-10 rule if you are seriously considering it.

Step 1: Calculate your income after taxes

The first step in the process is to determine your after-tax income, which is the total of your earnings after taxes. This will help you determine how much cash you have available each month for spending.

To figure out your take-home pay if you work as an employee, it might be as simple as looking at your paycheck. However, determining your take-home pay may be more challenging if you are an independent contractor or business owner.

Step 2: Calculate your spending and the necessary outlay.

If you’ve never used a budget before, this step can be challenging. Take your time and think about the expenses you’ve incurred over the past few months or years. If you think it’s not necessary, try to cut back on some of the spendings.

To stay organized and gain a clearer understanding of what needs to be done, make sure to keep notes on everything, including mortgage payments, dining out, student loans, groceries, and travel. It might be a spreadsheet that you print out from the internet or an Excel sheet.

Step 3: Make categories in the ratio 80:10:10

Once you have a list of your essential expenses and your financial savings goal, again, try to be as specific as possible to get a better idea of your expenses.

Managing daily expenses

Take some time to decide on financial goals that are in line with your future before you start any course of action. If you lack the drive to move forward and accomplish your initial goals, there is no point in budgeting.

It’s time to set aside 80% of your income for daily expenses once you’ve calculated your take-home pay. Set aside 80% of your income for necessities, such as rent or a mortgage, groceries, transportation, and utilities.

Setting up a financial goal

You must cover these costs each month in order to maintain a comfortable standard of living. Building a lifestyle that fits 10% of your income might require some research. Your monthly savings for retirement, emergencies, and other long-term objectives should be equal to this amount.

Spending on things you want

Spend only 10% of your income on wants. They include activities like eating out, watching movies, shopping, engaging in hobbies, and traveling that you like but may not necessarily need.

However, if you are conscious of your budgetary constraints, you might also want to spend money on a new wardrobe or go on a lavish vacation. The things that are important to you should be used as rewards for yourself.

Step 4: Making use of budgeting tools and making necessary adjustments to spending

Budgets can be challenging to follow, so you can use spreadsheets, apps, or online tools to monitor your spending and review your budget each month.

Keep an eye on your spending after you’ve made a budget, and make any necessary adjustments. If you find that you are spending too much in one place, try to cut back on another to maintain the 80-10-10 balance.

A simple and effective way to manage your money and reach your financial goals is to follow the 80-10-10 budget rule. By starting with these steps, you can start using this method of budgeting, which will help you get more financial stability and peace of mind.

It might take you a few months to get it right, but if you overspent in one category at the end of the month, you could make up for it the following month. If, over time, you are still having trouble adhering to the 80 10 10 rule, you may need to find a different percentage budget.

Alternate methods of budgeting

The 30 30 30 10 rule budget

The 30 30 30 10 rule, a straightforward budgeting technique, assists people in dividing their income into the following four categories:

- 30% for needs

- 30% for wants

- 30% for savings

- 10% for investing

Keep in mind that finding the best budgeting strategy for you may take some time.

The 80 20 rule budget

You are only permitted to spend 80% of your income in this situation, with the remaining 20% going toward savings. This method enables you to prioritize saving and is simple to use.

- 80% for all expenses

- 20% for savings

You can focus on achieving your financial objectives by focusing on the 20% of your budget that accounts for 80% of your expenses.

The 60 20 20 rule budget

The 60/20/20 rule is a very adaptable and simple method of budgeting. It provides a thorough strategy for handling your finances. You can easily understand where your money is going by categorizing your finances into three categories and making any necessary corrections. The three classifications comprise:

- 60% for essentials

- 20% toward saving

- 20% towards the financial goal

By adhering to this principle, you can build a strong financial foundation, prioritize your financial goals, and live a fulfilling life within your means.

The 70 20 10 rule budget

The percentage is divided into the following groups by this rule:

- 70% for necessities

- 20% for savings

- 10% for leisure/miscellaneous expenses

You can start managing your finances and achieving your financial objectives by adhering to the 70 20 10 rule. By planning your expenses, you can allocate your income in a way that works best for you. Of course, everyone’s financial situation is unique, so you should modify the percentage to meet your unique requirements. You can work toward long-term success and financial security by adhering to this rule.

Budget according to the 60-30-10 rule:

This budgeting advice states that you ought to divide your income into three groups.

- You must set aside 60% of your income for necessities like utilities, food, transportation, and other necessary bills.

- Spending discretionary money on things like a fancy vacation, shopping, fine dining, etc., should not exceed 30% of your income.

- Your savings and investment accounts should set aside 10% of your income.

You can make sure that you are prioritizing your spending, taking care of your basic needs, and still have some flexibility and room for future savings by following this rule.

It’s critical to keep in mind that this rule is only a suggestion and might not be appropriate in all circumstances. Your budget needs to be adjusted each time you assess your own financial situation.

The 60 40 rule budget

An effective tool for achieving financial balance is a budget based on the 60-40 rule. However, it requires commitment and restraint, just like any other budgeting technique. There are two categories for this technique:

- 60% for fixed expenses

- 40% for variable expenses

You’ll be well on your way to financial success if you continue to exercise restraint and stick to your spending plan.

Conclusion

The 80 10 10 rule budget is a straightforward yet efficient way to organize your money and set priorities for your spending. You can make sure you are taking care of your basic needs, saving for the future, and still allowing yourself some room for fun and enjoyment by dividing your income into three categories.

You can always try to cut back on some of your expenses, and you might need to do so if you need to keep your monthly payments for necessities under control to stay within your budget. Whichever way you look at it, you won’t know if the 80-10-10 rule budget actually works until you give it a shot. Try incorporating this rule into your budgeting strategy, and you’ll see the benefits for yourself.

FAQs

The Pareto principle also referred to as the 80 20 rule, is a theory that asserts that about 20% of causes account for 80% of effects. Among other areas of life, the concept can be used to enhance productivity, time management, and interpersonal relationships.

According to this method’s guidelines, you should set aside 70% of your income for living expenses, 20% for savings, long-term financial goals, or debt repayment, and 10% for wants like eating out, shopping, vacationing, etc.

The 50-30-20 rule, which states that you should set aside 50% of your income for necessities (mortgage, food, transportation, and bills), 30% for wants (entertainment, dining out, travel, and shopping), and 20% for investments, savings, and debt repayment, is the most straightforward and highly advised rule.

Yes, according to the 50-30-20 rule budget, which is thought to be the most widely used approach, it works based on the level of your monthly income. According to the 50-30-20 rule, you should divide your income into three different spending categories: needs and wants (50%) and discretionary spending (20%), savings and investments (20%).

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.