We all base our calculations on 100%, so there is no such rule as 60 40 20; however, the given rule is greater than that number by more than 100. But let me introduce you to a method that is very similar to the rule you’re looking for: The 60-40 budget rule.

Now that I’m a blogger, I’d like to start off with the 60-40 rule budget. This rule is a straightforward and efficient way to manage your finances and enables you to divide your income among various aspects of your life. The 60-40 rule is a great way to balance your spending, make sure you’re living within your means, and make sure you’re accomplishing your goals. It is crucial to remember that the rule is adaptable and can be changed depending on your unique situation. You might be able to allocate more money to savings and investments if, for instance, you have a high income and low expense ratio.

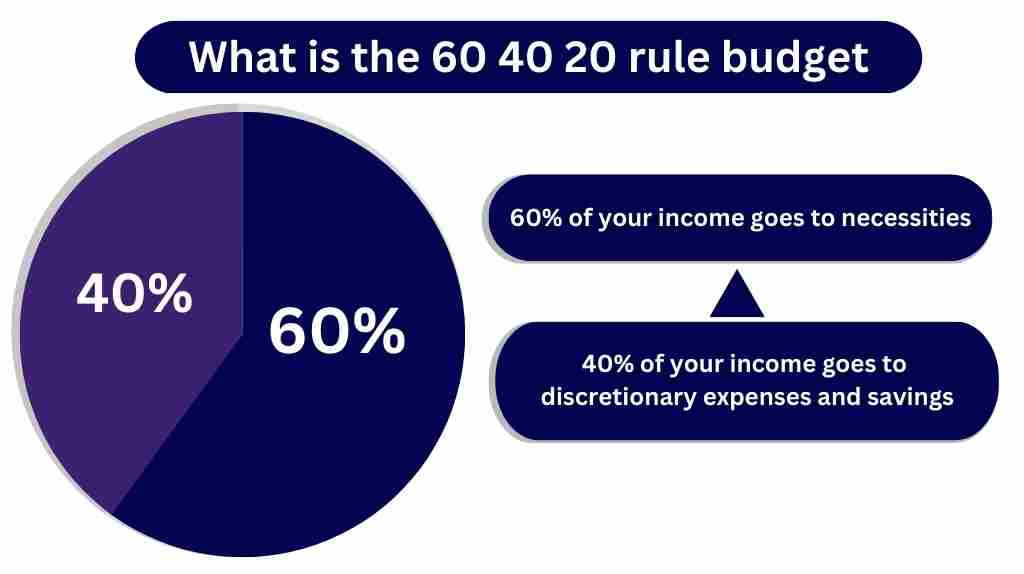

According to this rule, you should set aside 60% of your income for necessities like rent or a mortgage, a vehicle, food, utilities, and other items. The remaining 40% should be distributed equally between your discretionary spending, which includes hobbies and entertainment, and your financial objectives, which include savings and investments.

A further incentive to save for the future while also enjoying the present is provided by the 40% split between discretionary spending and savings.

How to implement the 60 40 rule budget in your life?

Begin by keeping a record of your income and expenses for a month before putting the 60/40 rule into practice. Next, split your income 60/40 and distribute the money in the proper proportions. If you discover that your expenses exceed 60% of your income, look into ways to cut back on your spending or boost your earnings. If you find that you have extra money, consider putting more toward savings or discretionary spending.

60% of your assets are placed in equities and 40% in bonds in a 60/40 portfolio. The 60/40 split aims to generate returns even during times of market volatility while lowering risk. It might not generate as high returns as an all-equity portfolio, which is a potential drawback.

After having established that you need to split the income into two categories, let’s get into deep detail about each —

60% of your income goes to necessities: Some of the examples that fall into this category are:

- Cost of housing (rent/mortgage, utilities, insurance)

- Transportation expenses (car payments, gas, and public transportation)

- Food and groceries

- cost of medical care (insurance premiums, doctor visits)

- Student loan

40% of your income goes to discretionary expenses and savings: Examples that fall under this category are:

- leisure activities (movies, dining out, and travel)

- Travel

- Raising emergency fund

- Shopping

- Paying off debt

Finding your after-tax income, or the amount of money left over from your paycheck after taxes and other deductions is the first step.

The essential monthly costs that you must cover are known as fixed expenses. Examples include mortgage or rent payments, insurance premiums, utility bills, and car payments. Make sure your overall expenses do not total more than 60% of your post-tax income by totaling them all up.

Non-essential expenditures like taking a fancy vacation, shopping, eating out, and other such expenses are referred to as discretionary expenses and can be avoided if necessary. For these costs, set aside 40% of your income.

You may need to adjust your budget by lowering discretionary spending or looking for ways to lower fixed expenses if you discover that your expenses are higher than 60% of your after-tax income. In a similar vein, if you discover that you still have a sizable surplus of cash after paying your fixed costs, you might be able to set aside more for discretionary spending or savings.

By ensuring that you have enough money to cover necessary expenses while still having some leeway for discretionary spending, this budgeting strategy aims to help you maintain financial stability.

60 40 20 rule budgeting Calculator

| Necessities: | 60% | $0.00 |

| Discretionary Expenses and Savings: | 40% | $0.00 |

Some suggestions to increase your success with this rule

Spending with integrity: Be truthful with yourself about your current spending habits and make the necessary budget adjustments. You might need to allocate more money to fixed expenses if you have a tendency to overspend on discretionary costs in order to rein yourself in.

Giving advantage to your future goals: Make saving a priority by giving it some of your discretionary spending money so that you can put it toward things like an emergency fund or retirement account. By doing this, you can create a financial safety net and get ready for unforeseen costs.

Monitor your spending: Keep a record of your outgoing costs to ensure you adhere to your spending plan. To help you stay on track, you can use a budgeting app or spreadsheet.

Advantages of the 60/40 budget rule

Budgeting according to the 60-40 rule can also assist you in saving money. You can avoid overspending on discretionary items by directing a sizeable portion of your income toward your essential expenses. Furthermore, you can save and invest with the 40% designated for discretionary costs, which will aid your long-term wealth accumulation.

Simple to use: It is simple to comprehend and put rule 60 40 into practice. You must set aside 40% of your income for discretionary expenses and 60% of your income for essential expenses when using this simple and straightforward budgeting technique.

Flexibility is possible: because 40% of your budget is set aside for discretionary costs like going to the movies, eating at restaurants, taking luxurious vacations, etc.

Prioritize your spending by using the 60-40 rule budget: By designating 60% of your income for necessities like food, utilities, rent or a mortgage, and transportation. Your most basic needs will be taken care of, you can be sure. This may offer security and lessen financial pressure.

gives you a sense of control: You can feel more in control of your finances by creating a budget. By separating your income into distinct categories, you can manage your spending and avoid making impulsive purchases. You can accomplish your financial objectives by doing this.

Disadvantages of 60 40 rule budget

A budgeting strategy known as the 60-40 rule recommends allocating 60% of your income to fixed expenses and 40% to variable expenses. Although this approach has a number of potential drawbacks, it can be useful in some circumstances.

Debt is ignored: If you have debt, such as credit card debt or student loans, the 60-40 budget may not adequately address it. It can result in higher interest rates and financial stress because the method does not place a priority on paying off debt.

ignores changes in income: if your income varies from month to month, the 60-40 rule might not be appropriate. The approach takes into account a steady income, which might not accurately represent your current financial situation.

Misclassification of expenses: The 60-40 rule budget divides expenses into fixed and variable categories, but some costs may not neatly fit into either. For instance, even though your grocery costs may change from month to month, they are still regarded as fixed expenses.

Alternate methods of budgeting

One of the strategies most frequently used in bulk is the 50 30 20 rule:

This rule recommends that you spend 50% of your income on necessities, 30% on discretionary items, and 20% on savings or debt repayment.

Here are some steps on how to implement the 50 30 20 rule budget:

Step. 1- Determine your monthly income as the money left over from your paycheck after taxes and other deductions.

Step. 2- You must set aside 50% of your income for necessities, such as your rent or mortgage payment, groceries, transportation, utilities, and other necessary outlays. You may need to reassess your spending and look for ways to cut costs if your necessary expenses are greater than 50% of your total expenses.

Step.3- Allocate 30% of your income for discretionary expenses, such as eating out, shopping, opulent vacations, etc. Remembering that this is a discretionary category will help you determine whether you need to make any cuts if you discover that you are overspending here.

Step. 4– Set aside 20% of your income for savings or debt repayment. This covers matters such as setting aside money for emergencies, retirement, and debt repayment. You should prioritize repaying any high-interest debt you may have before increasing your savings.

If you want to take a more flexible approach to the budget, the 50 30 20 rule may be a good choice. While prioritizing savings and debt repayment, it permits greater discretionary spending. Keep in mind that maintaining a budget plan over time and making necessary adjustments are the keys to success.

Budget according to the 60-30-10 rule:

According to this budgeting advice, you should divide your income into three categories.

- You must set aside 60% of your income for necessities like utilities, food, transportation, and other necessary bills.

- Spending discretionary money on things like a fancy vacation, shopping, fine dining, etc. should not exceed 30% of your income.

- Your savings and investment accounts should be set aside 10% of your income.

By following this rule, you can prioritize your spending and ensure that you are meeting your basic needs, while also allowing room for some flexibility and saving for the future.

The fact that this rule is only a suggestion and might not apply to everyone should be noted. A budget should always be modified in accordance with an assessment of your personal financial situation.

The 60/20/20 rule for budgeting:

One of the best ways to achieve financial stability is to stick to this budget. According to this rule, you should devote 60% of your income to necessary expenses, 20% to financial goals, and the remaining 20% to discretionary costs.

According to this rule, you need to categorize your income into three categories:

- For necessities like food, transportation, utilities, and rent or mortgage payments, set aside 60% of your income.

- You should set aside 20% of your income for financial objectives in the future, such as debt repayment and investment.

- You can spend up to 20% of your income on things like entertainment, hobbies, vacations, dining out, and other discretionary expenses.

As a result, the 60 20 20 rule is a great budgeting technique that can aid in money management and the accomplishment of financial objectives.

The 30 30 30 10 rule:

This is a budgeting principle that advises dividing your income into the following four categories:

Housing costs, such as rent or mortgage payments, property taxes, utilities, and homeowner’s insurance, should not exceed 30% of your income.

30% of your income should be set aside for living expenses, which include things like groceries, gas, internet, and transportation.

For debt repayment, retirement, unexpected expenses, and other financial goals, you should set aside 30% of your income.

10% of your income goes toward wants, such as eating out frequently, taking expensive vacations, entertainment, and travel. Visit for more information on the 30 30 30 10

Conclusion

By adhering to this guideline, you can control your spending, guarantee that you have enough money set aside for necessities, and still have some flexibility and fun. But keep in mind that this is just a generalization, so it might not be applicable to everyone. You may need to change the percentages based on your unique financial goal in order to meet your needs.

It can be said that the 60-40 rule budget is a helpful framework for handling personal finances after exploring and analyzing it. It’s crucial to remember that the 60-40 rule is only a general suggestion and that each person’s budget should be modified to account for their unique needs and financial circumstances.

In order to make sure that your budget remains in line with your financial priorities and goals, it’s also crucial to review and update it on a regular basis. All things considered, the 60-40 rule is a helpful tool for handling personal finances and can assist people in achieving stability and security.

FAQs

As a quick and easy way to manage your money and reach your financial objectives, this rule is frequently suggested by financial experts. It advises allocating 50% of your income to necessities, 30% to discretionary spending, and 20% to debt repayment and savings.

According to the 70-20-10 budget rule, you should spend 70% of your income on necessities, 20% on long-term financial goals, and 10% on discretionary items.

In business, a project management rule known as “the 30 30 30 10 rule” is used, particularly in the planning stage.

Although the 7% rule is frequently used as a benchmark for long-term investment planning and goal setting, it’s crucial for investors to carefully consider their unique financial goals, risk tolerance, and investment strategies before making any investment decisions.

Under the assumption of continuously compounding interest, the rule of 69 is used to calculate how long it will take for an investment to double. Divide 69 by the investment’s rate of return, and then round the result up to the nearest 0.35.