I’m glad you’re here. In this blog, I’ll be talking about the 60 20 20 budgeting rule. Living a stable and contented life requires good money management. Maintaining a budget makes it easier to prioritize your spending in order to achieve your financial objectives. The 60/20/20 rule is a popular budgeting strategy that can help you become more adept at managing your finances.

What the 60/20/20 rule is and how to apply it to your life will be covered in this blog post.

Your ability to control where you want to spend money is facilitated by using a budget. However, because there are so many different ways to budget, it can occasionally be overwhelming. The 60/20/20 rule is said to be a straightforward budget that can help you spend less and save more.

This article will assist you in comprehending the rule, applying it, and determining whether it is appropriate for you. A common alternative budget will also be covered.

What is the 60 20 20 rule?

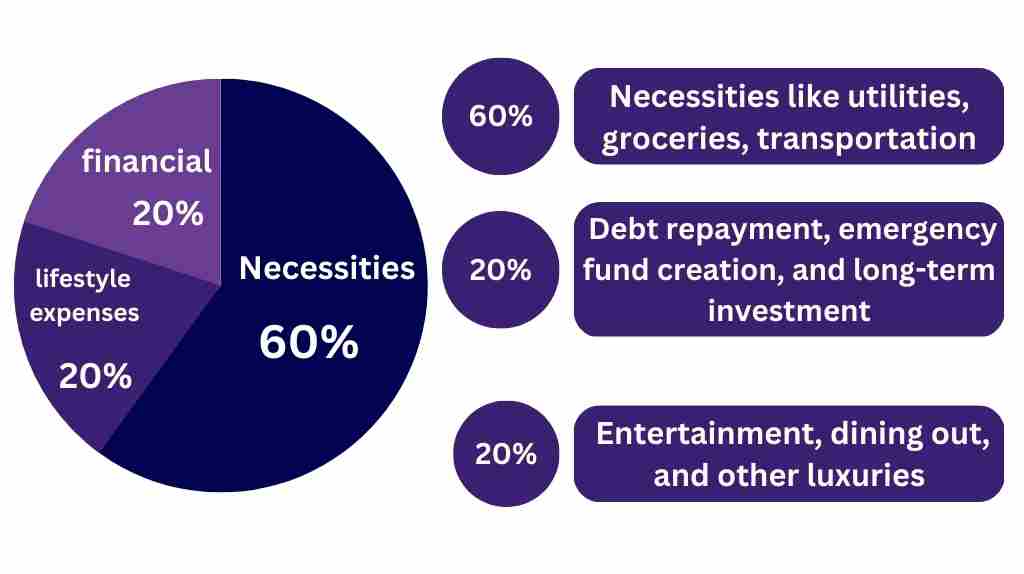

According to the 60/20/20 rule, you should divide your income into three categories: necessities, financial objectives, and lifestyle costs. According to the rule, you should set aside 60% of your income for necessities like your mortgage or rent, utilities, groceries, and transportation. You should allocate 20% of your income toward your financial objectives, including debt repayment, emergency fund savings, and retirement investments. You can spend the remaining 20% of your income on lifestyle expenses like eating out, shopping, taking a fancy vacation, and other non-essential costs.

The 60 20 20 system is simple to set up and adhere to, just like other percentage budgeting methods. In order to automatically budget using the 60 20 20 rule, you can use your tools, such as direct deposits and automatic savings transfers.

The 60/20/20 rule’s primary benefit is that it already makes sure you don’t lose momentum and spend all of your allotted funds. You will undoubtedly stay motivated if your budget requires you to pay off your debts as quickly as possible.

60 20 20 rule budget calculator

Results

How to start budgeting with the 60 20 20 rule

In order to put the 60 20 20 rule into practice, you must first determine your net income, which is the amount of money you receive after taxes and other deductions. After determining your net income, you can divide it into three groups: expenses for necessities, financial objectives, and lifestyle.

60% of income for living expenses: Begin setting aside 60% of your income for necessities like utilities, groceries, transportation, and other daily costs.

20% of income for financial goals: Set aside 20% of your income for financial objectives like debt repayment, emergency fund creation, and long-term investment. You can achieve your financial goals and ensure long-term financial stability by using this category, which is essential.

20% of income for discretionary spending: The remaining 20% of income will go toward lifestyle costs like entertainment, dining out, and other luxuries. Overspending here should be avoided, as it can result in a precarious financial situation.

Considering that your monthly income is $5000 then $3000 will be for living expenses,

$1000 will be allocated for setting financial goals, and the remaining $1000 will be for spending on what you want, like dining out, going on vacation, shopping, and another discretionary spending.

Guidelines for effective budgeting on 60 20 20 rule

Prioritize your expenses: Put your expenses in order of importance by deciding which are necessary and which are not. By doing this, you can organize your spending by priority and make sure that your money is spent wisely.

Adjust your spending: By keeping track of your spending, you can find out where you might be overspending and adjust your spending accordingly.

Be adaptable: Life can occasionally be unpredictably expensive. To account for these costs, be adaptable and change your budget as necessary.

Automate your savings: You can achieve your financial objectives more quickly and easily by automating your savings. To make sure you consistently save, you can set up automatic transfers to your savings accounts, retirement accounts, or debt repayments.

Advantages of using 60 20 20 rule budget method

This budget ensures that you put saving first while allowing you more freedom to spend some of your money how you want. A savings account provides you with the security you need in case of an emergency, loss of employment, or medical emergency, even though managing debt and spending is the key to financial stability.

You have a lot of flexibility with the 60 20 20 rule to customize it. The 60 20 20 budgets establish adequate boundaries and are straightforward to follow. In this way, you always know where your money is going and are in control of your financial decisions.

Disadvantages of the 60 20 20 rule budget

As a one-size-fits-all strategy, the 60 20 20 rule budgeting method might not be suitable for everyone. Individuals’ needs, goals, and financial situations can differ greatly, and this budgeting approach might not take that into account. This method of budgeting does not include tracking every dollar spent. Although it offers a general framework for allocating funds, it might not include a specific strategy for keeping track of costs and managing finances.

The 20% set aside for savings and debt repayment can be a good place to start, but it might not be enough to pay for retirement expenses. A different approach to budgeting might be required for people who have long-term financial objectives, like retirement planning.

Alternate methods of budgeting

As we all know, there are people with different monthly incomes. So, the 60 20 20 rule of budgeting may not work for everyone. Remember, the rules of budgeting always depend upon the income factor.

If 60/20/20 doesn’t work for you, then you need not worry; go and visit our site, finaap.com, where you’ll find a detailed explanation of the budgeting methods that might suit you. Before that, let’s have a quick look at the alternative methods of budgeting.

The 50-30-20 rule:

This technique for handling personal finances suggests dividing your after-tax income into three categories:

- 50% of your income for needs

- 30% of your income for wants

- 20% of your income for savings and debt repayment

This guideline can serve as a useful starting point for developing a budget that is in line with your values and monetary objectives.

The 70 20 10 rule:

This rule suggests that you categorize your income into three parts:

- 70% of your income for living expenses

- 20% of your income for financial goals

- 10% of your income for discretionary expenses such as dining out, shopping, entertainment, etc.

The 60 30 10 rule:

This rule suggests that you allocate your income into three categories:

- 60% of your income for savings and investment

- 30% of your income for living expenses

- 10% of your income for wants

This rule might not apply to everyone, but if you have a plan and follow it, it might work effectively. For a detailed article on the 60 30 10 rule, you can visit.

The 30 30 30 10 rule:

According to the 30 30 30 10 rule, your income should be divided into the following four groups:

- 30% of income for housing expenses

- 30% of income for necessities

- 30% of income for discretionary expenses

- 10% of income for savings

Please visit to read a comprehensive article on the 30 30 30 10 rule.

Conclusion

The 60 20 20 method of budgeting is a useful one that can aid in effective money management. You can make sure that your spending is prioritized and that your financial goals are met by dividing your income into three categories: necessities, financial goals, and lifestyle expenses. To get the most out of this budgeting technique, keep track of your spending, automate your savings, and be flexible.

The 60/20/20 method is a great tool for allocating your funds, as is any other percentage-based budget. You can use these systems to make sure you pay all of your bills on time each month. Additionally, they can show you whether you’re overspending in particular areas, such as on unnecessary items.

The 60 20 20 method is an easy way to start budgeting because it’s straightforward to calculate.

Please give it a go right now.

FAQs

Your specific financial objectives and the situation will determine whether or not the 60/20/20 rule is wise. If you’re just beginning to gain control over your finances, it can be a useful guide for budgeting and money management. It might not be suitable for everyone, though.

The easiest and most recommendable rule is the 50-30-20 rule, which states that you should set aside 50% of your income for necessities (mortgage, food, transportation, and bills), 30% for wants (entertainment, dining out, travel, and shopping), and 20% for investments, savings, and debt repayment.

This rule suggests that 70% of your income must be dedicated to necessities,20% must be used in setting up future financial goals, and the remaining 10% you can use for your wants like dining out, shopping, entertainment, etc.

The 60/20/10 rule is a personal finance tip that advises dividing your income into different categories: 60% of your income should go toward essentials, 20% should go toward savings and debt repayment, 10% should go toward investing in long-term goals, and the remaining 10% should go toward discretionary spending.

The Pareto principle, also known as the 80/20 rule, is a theory that holds that roughly 20% of causes account for 80% of effects. The idea can be used to improve productivity, time management, and interpersonal relationships, among other facets of life.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thank you for your kind words, I’m glad to hear that my point of view was interesting to you. And of course, I’m here to help and answer any questions you may have, so please feel free to ask away!

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?