It’s possible that when you sit down to make your first budget, you’ll discover that you have no idea how much you spend on anything. Saving money is a good idea no matter what, but most people find that creating a budget is intimidating because it forces them to confront their financial situation.

For those who have trouble using complicated budgeting techniques, the 30 30 30 10 rule is perfect. You can manage your finances and save money by using the 30 30 30 10 rule, which is a straightforward budgeting method.

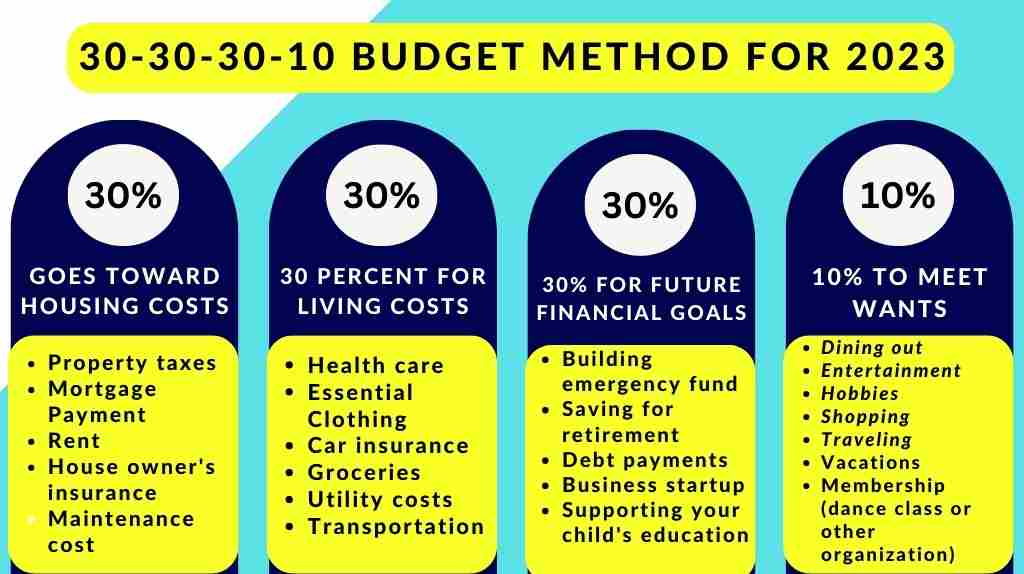

This guideline recommends categorizing your income into the following four groups:

- 30% goes toward housing costs

- 30 percent for living costs

- 30% for future financial goals

- 10% to meet wants

A budget can do a lot of things for you, including ensuring that you pay your bills on time, aiding in debt relief, eradicating bad spending patterns, assisting in saving money, and more. It can be extremely annoying at the same time.

The 30 30 30 10 rule is explained in detail.

The 30 30 30 10 rule is a simple approach to setting up a financial plan. The 30-30-10 rule budget allocates 30 percent of your monthly income to housing costs, 30 percent to necessities, 30 percent to financial goals like savings, and the remaining 10% of the budget is set aside for wants like recreation, hobbies, vacations, etc.

Let’s examine each of these subcategories in more detail.

30% of income for Housing

Housing costs should be covered by the first 30% of income. This covers the cost of the mortgage, the home’s insurance, the property taxes, and any maintenance obligations.

It’s crucial to set money aside as a landlord in case unexpected repairs or improvements are needed. Your top priority should fall under this category because having a secure and comfortable home is essential.

Some of the examples that come under the “housing” category are given below:

- Property taxes

- Mortgage Payment

- Rent

- House owner’s insurance

- Maintenance cost

If you have a monthly income of $5000, then $1500 will be dedicated to the housing category.

30% of income for Living Expenses

This second portion, which comprises 30%, is allocated to necessary living expenses like utilities, groceries, healthcare, transportation, necessary clothing, auto insurance, and other day-to-day expenses. Debt repayments and required insurance premium payments should also be taken into account.

While maintaining a high standard of living, make an effort to keep these costs as low as you can. Don’t forget to include any periodic costs that are necessary but don’t happen every month, such as car registration, yearly dues, or quarterly bills.

Here are a few examples of what falls under the “Needs” category:

- Health care

- Essential Clothing

- Car insurance

- Groceries

- Utility costs

- Transportation

- Loans

- household goods

$1500 will be set aside for all types of living expenses, assuming your monthly income is $5000.

30% of income for Future Goals

The third 30% of income should be allocated to future goals. Your financial objectives might be to pay off credit card debt, retire student loan debt, accumulate an emergency fund to act as a safety net, or save for retirement.

Financial objectives are the focus of this category, and they don’t just have to involve you setting aside money to make a purchase. There are many different types of financial goals you can have, and having multiple goals is crucial.

Examples of what falls under the goals category include the following:

- Building emergency fund

- Saving for retirement

- Debt payments

- Business startup

- Supporting your child’s education

- Real estate investment

- Buying a house

Considering that you make $5,000 per month, you will set aside $1500 each month for future goals, which will total $18,000 per year, which is a significant amount.

10% of income for wants

The remaining 10% of your income, or everything that is not essential, will be allocated to the wants category. This is your amusing money jar.

Some of the examples for this category are:

- Dining out

- Entertainment

- Hobbies

- Shopping

- Traveling

- Vacations

- Membership (dance class or other organization)

Always keep in mind that saving money is your main priority; only spend money in this category if absolutely necessary.

How to begin budgeting with the 30 30 30 10 rule

The 30 30 30 10 rule budget aims to make your financial planning easier. The majority of expenses can be categorized, which makes it simpler to allocate your funds. Furthermore, you get to spend a portion of your income on enjoyable purchases or experiences, giving you some flexibility.

So let’s get started with the budgeting 30 30 30 10 rule steps.

Step. 1: Determining your monthly income

The first and most important thing you should do before creating a budget is to determine your monthly income, which is income after tax. That is reasonably straightforward if your monthly income remains constant. You can quickly obtain a reliable number by using your paystubs as a guide.

Some people will find it simple to add up their income. If you are a salaried employee, it probably stays the same from month to month. But if you are a contractor or a businessman,

month to month, variations are possible. If your income fluctuates from month to month, you can either stick to your budget’s lowest typical income level or take the average of all the months instead. If that doesn’t work out perfectly, you might want to base your budget on the month with the lowest income.

Keep in mind that your budget should account for the financial strategy you’ll employ to achieve your goals.

Step.2: Determine your spending and you’re outlays

Generally, this is the amount where you pay essentially the same amount every month. Make a note of your spending details. Keep a record of your fixed expenses, such as rent; average out your variable expenses, such as electricity, and don’t forget about one-time or irregular expenses, such as school funding.

Here you need to take care of three kinds of expenses

- Fixed expenses

- Variable expenses

- Periodic expenses

You can use spreadsheets to make separate notes for each kind of expense.

Step. 3: Divide your income into the appropriate categories

You must now divide your entire income into the following four categories: housing, needs, goals, and wants. To have a clearer understanding of your expenses, try to be as specific as you can once more.

It’s time to organize your spending once you have a complete list of all of your outgoings.

Simple rules apply to housing, which must account for 30% of gross income. whereas living expenses and financial objectives each account for 30% of income. The remaining 10% of the income will be allocated to wants which include dining out, going for a lavish vacation, shopping, etc.

Step. 4: Setting up financial goals

When you know how much money you’ll make, how much will go to each category, and how it will all be paid for, you need to set financial goals. You need to establish some monetary objectives for every month or even the entire year. Purchasing a home, paying off a sizable debt, setting up an emergency fund, preparing for retirement, and paying for a child’s education are a few examples.

Setting goals will not only make sure that you’re spending your money on things you truly value and that will help you live the life of your dreams, but it will also keep you motivated to save. Because you didn’t know your income and expenses at first, you didn’t set any financial goals. Since you are aware of your financial situation, you can now set attainable financial goals.

Step. 5: Modifying spending as necessary

To determine whether your total falls within the 30 30 30 10 budget framework, you must add up your spending in each category after categorizing. Your budget is practically finished if this is the case. It’s possible that not everything fits exactly within the parameters of the 30-30-30-10 budget rule percentages once you’ve totaled and organized everything. In that case, you have two options: cut costs or boost revenue.

You might need to adjust your budget if you discover that one area of your spending is out of control. For instance, you might need to spend less on entertainment or figure out how to save money on transportation.

30/30/30/10 Rule Budgeting Calculator

Results:

| Category | Amount |

|---|---|

| Housing Costs (30%) | |

| Living Costs (30%) | |

| Future Financial Goals (30%) | |

| Wants (10%) |

Does the 30 30 30 10 rule work for you?

The 30-30-30-10 budget rule, like other percentage-based budgeting strategies, makes the assumption that all of your expenses will fall into the designated buckets. What happens if your ongoing medical costs or housing expenses cause you to exceed the 30% cap for the category of housing or necessities expenses?

Percentage-based rules might not be effective if your income fluctuates, you receive irregular payments, or you work a low-paying job. If the math doesn’t add up, you might be better off finding a different spending plan that works for your situation.

Even though keeping things simple when it comes to personal finance is generally a good thing, it’s not always possible. The housing and needs category should always come first, and the percentages should be adjusted for the categories of wants and goals. Once you’ve made a few attempts, you start resetting the percentages to 30/30/30/10. But keep in mind that part of a successful budget is spending money on things you find enjoyable and having no financial goals.

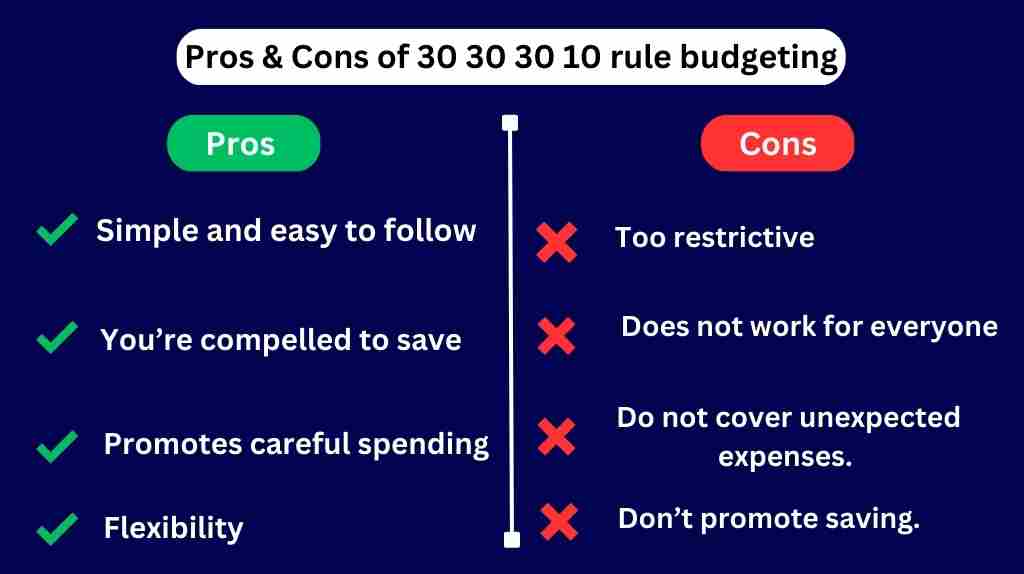

Pros and cons of the 30 30 30 10 rule budget

| Pros | Cons |

|---|---|

| Simple and easy to follow | Too restrictive |

| You’re compelled to save | Does not work for everyone |

| Promotes careful spending | Do not cover unexpected expenses. |

| Flexibility | Don’t promote saving. |

What is the 60 30 10 rule budget?

The 60/30/10 rule budget is primarily based on the idea of saving money, and the number represents the weights assigned to debt, daily expenses, and leisure or hobbies, respectively.

This budget rule benefits people who are excellent money savers because its main objective is to save money for subsequent financial objectives. This rule benefits both your current, very balanced management as well as your long-term goals.

Because 60% of their income is set aside for savings, this is perfect for people who want to purchase a home and pay off significant debt. Additionally, 30% will be allocated to daily expenses such as food, transportation, utilities, and other basic necessities. 10% can be used to purchase a movie or other item from your wishlist, but only if it is absolutely necessary.

The 60-30-10 rule can be a useful tool for ensuring that your spending is balanced and that you aren’t overspending on discretionary items or neglecting savings. However, it’s crucial to modify the percentages in accordance with the person’s priorities and financial situation.

Visit for more information on the 60 30 10

Conclusion

The advantage of using this budgeting approach is that it places a higher priority on saving and debt repayment, which can assist you in achieving long-term financial objectives like debt repayment, emergency fund development, and retirement savings.

It’s important to keep in mind, though, that not everyone can use the 30 30 30 10 rule, and you may need to change the percentages to better suit your needs depending on your specific situation. If you live in a region with high housing costs, for example, you might need to set aside more than 30% of your income for housing costs.

To sum up, the 30 30 30 10 rule is a helpful tool for managing your money and achieving your financial objectives. You can take charge of your money and lay a solid financial foundation for the future by adhering to these recommendations and making adjustments as necessary.

FAQs

This method gives guidelines that 70% of your income is dedicated to living expenses, 20% is allocated for savings, long-term financial goals, or paying off debt, and the remaining 10% is for wants like dining out, shopping, vacation, etc.

The 110 rule for investing is a straightforward principle that suggests deducting your age from 110 to determine the proportion of your portfolio that should be invested in stocks or riskier assets, with the remaining amount allocated to less risky investments like bonds or cash.

According to this rule, you must divide your post-tax income into three groups:

50% for essential expenses

20% for savings and investment, including an emergency fund, long-term goals

10% for personal goals, or discretionary spending.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your article helped me a lot, is there any more related content? Thanks!

Your article helped me a lot, is there any more related content? Thanks!