Everyone in the world struggles to manage their budgets. People begin to believe they can change their lifestyles without considering their budget. Here is a straightforward guideline: the 60/30/10 rule budget.

The 60/30/10 budget rule may not work for everyone, but it can be adapted so that most people with low incomes can use it as a benchmark for their long-term financial objectives.

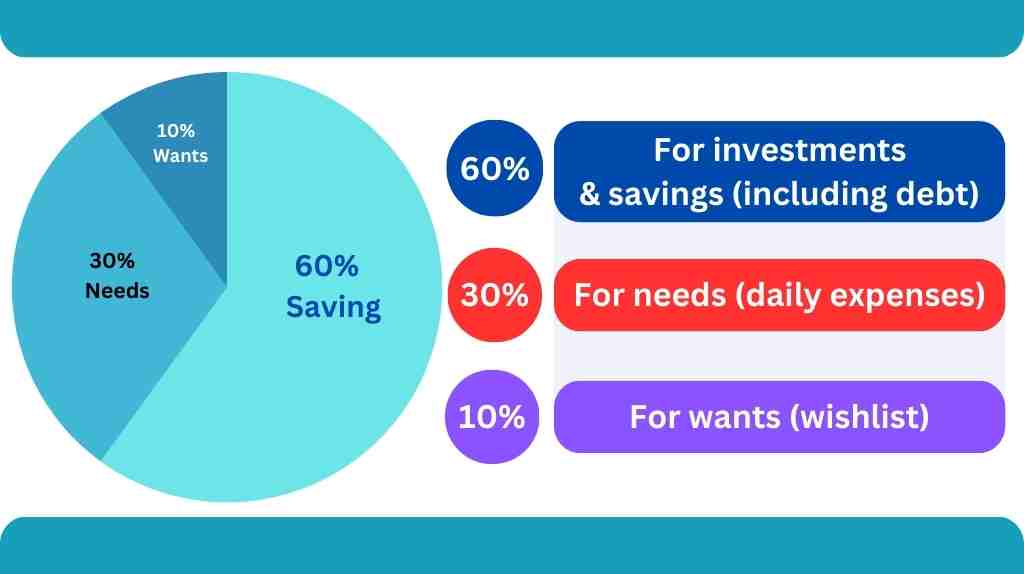

According to the 60/30/10 rule budget, there are three ways to categorize income:

i) 60% for investments and savings (including debt)

ii) 30% for needs (daily expenses)

iii)10% for wants (wishlist)

Are you the one who has trouble managing your budget? With 60/30/10 for future financial goals, let’s take a peek at the world of financial management.

What is the 60/30/10 rule budget?

The 60/30/10 rule budget is based primarily on the concept of saving money, and the number itself denotes the weightage for saving/investment (including debt), daily expenses, and entertainment or hobbies, respectively.

Due to the fact that the primary goal of this budget rule is to save money for future financial goals, it is advantageous for people who are excellent money savers. This rule not only benefits long-term objectives but also your present-day management, which is very well-balanced.

This is ideal for those who intend to buy a home and pay off substantial debt because 60% of their income is set aside for savings. And 30% will go toward daily costs like food, transportation, utilities, and other necessities of life. 10% can be spent on a movie or something else on your wishlist, but only if it is absolutely necessary.

Although applying the strategy to this rule may be difficult for those with low incomes, everyone can do so as long as they place some restrictions on expensive items like housing and food. Furthermore, those with high incomes might find that this rule prevents them from leading a lavish lifestyle.

If the 60/30/10 approach doesn’t work for you, try 50/30/20 instead, where 50% can be used for debt repayment, investments, or savings. At the same time, 30% can be used for regular costs like bills, rent, groceries, and transportation. The remaining 20% can be used for your wants.

Investing or saving 60% of income

Because most people are so concerned with saving money, they frequently struggle to maintain consistency in this area (which accounts for 60% of income). 60% of the funds will go toward achieving future financial objectives, such as setting up an emergency fund, saving for retirement, or making investments in your education or professional development.

Prioritize the objectives that will improve your life the most over the long term when budgeting for your future goals. The 60% of the 60/30/10 rule budget includes the following:

- Savings

- Investment

- Emergency fund

- Paying off debts

- Education fund

- Business startup

Assuming a person makes $5000 per month, $3000 of that amount will go toward saving. And these savings will add up to $36,000, which is a significant sum. Despite the fact that it seems like a lot of money to save all at once, you will have already made $36,000 toward your goal in just one year. This is an advantage of the 60/30/10 budget rule.

Daily expenses 30% of income

The needs category, which includes all the costs you can’t avoid or would find difficult to live without, will receive 30% of your income. Prioritize the necessities while ensuring that you have 30% saved to cover all expenses.

A maximum of 30% of the income should come from this category. If you discover that you are spending more than 30% on necessities, you may need to examine your spending patterns or look into ways to cut costs.

This category includes:

- Groceries

- Rent/mortgage

- Housing

- Transportation

- Household goods

- Pharmaceutical

- Insurance

- Monthly bills

- Loans

Again, using the example of a person making $5000 per month, the minimum requirement will be met by $1500. The 60/30/10 rule budget will meet all basic needs without creating a problem of saving over needs.

Wants or wishlist 10% of income

The 60/30/10 rule budget’s final category is wants. You can set aside this 10% of your income for any purchases you make or additions to your wardrobe. A maximum of 10% of your income should go toward this category. This category allocates with :

- Entertainment (Movie tickets)

- Shopping

- Traveling

- Dates

- Any memberships (gym/club)

- Dining out

- Parlour

- vacations

Putting a priority on your wants and spending money on things that make you happy and fulfilled is important, but you should also be careful to avoid going into debt or overspending.

Considering a person with a $5000 monthly income can keep aside $500 for the wish list.

60 30 10 rule Budget Calculator

How to begin budgeting with the 60 30 10 rule

You might be wondering who would prosper under the 60 30 10 rule budget after seeing the percentages. If you want to use the 60-30-10 rule budget to help you reach your financial objectives, getting started with it is very simple.

Here is how to create a budget using the 60-30-10 rule if you are seriously considering it.

Step.1: Determine your after-tax income

The first step in the process is to determine your after-tax income, which is the total of your earnings after taxes. This will help you determine how much cash you have available each month for spending.

To figure out your take-home pay if you work as an employee, it might be as simple as looking at your paycheck. However, determining your take-home pay may be more challenging if you are an independent contractor or business owner.

Step. 2: Determine your spending and the expenses you must make

If you’ve never used a budget before, this step can be challenging. Take your time and think about the expenses you’ve incurred over the past few months or years. If you think it’s not necessary, try to cut back on some of the spendings.

To stay organized and gain a clearer understanding of what needs to be done, make sure to keep notes on everything, including mortgage payments, dining out, student loans, groceries, and travel. It might be a spreadsheet that you print out from the internet or an Excel sheet.

Step. 3: Making categories in the ratio 60:30:10

Once you have a list of your essential expenses and your financial savings goal. Again, try to be as specific as possible to get a better idea of your expenses.

Setting up a financial goal

Take some time to decide on financial goals that are in line with your future before you start any course of action. If you lack the drive to move forward and accomplish your initial goals, there is no point in budgeting.

It’s time to set aside 60% of your income for future goals once you’ve calculated your take-home pay. Your monthly savings for retirement, emergencies, and other long-term objectives should be equal to this amount.

Managing daily expenses

You must cover these costs each month in order to maintain a comfortable standard of living. Building a lifestyle that fits 30% of your income might require some research. Set aside 30% of your income for necessities, such as rent or a mortgage, groceries, transportation, and utilities.

Spending on things you want

Spend only 10% of your income on wants. They include activities like eating out, watching movies, shopping, engaging in hobbies, and traveling that you like but may not necessarily need.

Nevertheless, if you are aware of your spending restrictions, you might also want to invest in a new wardrobe or take a luxurious vacation. It’s also crucial to reward yourself with the things that are important to you.

Step. 4: Utilizing budgeting tools and modifying spending as necessary

Budgets can be difficult to stick to, so you can use spreadsheets, apps, or online tools as budgeting tools to keep track of your spending and review your budget each month.

After you’ve created a budget, keep track of your spending and make necessary adjustments. To keep the 60-30-10 balance, if you discover that you are overspending in one area, try to make cuts in another.

The 60-30-10 budget rule is a straightforward and practical method for handling your money and achieving your financial objectives. You can get started using this method of budgeting by following these steps, which will help you achieve greater monetary stability and mental peace.

It might take you a few months to get it right, but if you overspent in one category at the end of the month, you can make up for it in the following month. However, you might need to find a different percentage budget if, over time, you are still having trouble sticking to the 60 30 10 rule.

Does the 60-30-10 rule work for me?

For anyone who wants to improve their financial situation, the 60 30 10 rule finance is a tempting option. It’s crucial to remember that the 60-30-10 rule is only a suggestion and might not apply to everyone’s particular financial circumstances. It takes a lot of commitment to make saving half of your paycheck work, so it’s not for everyone.

Take a moment to honestly consider your current income before you dive in. This plan might initially appear to be too extreme if your income is lower. However, everyone can develop a budgeting strategy. This may not be the budget for you if you discover that you cannot afford to pay your daily expenses without going overboard on your wants.

Naturally, if you need to start saving right away, there are a lot of other percentage budgeting methods you can try. Making a budget that works for you and your financial situation and regularly reviewing and making necessary adjustments to it to ensure that you are reaching your financial goals is most crucial.

60-30-10 rule of investing

When allocating assets, the 60-30-10 rule is a condensed general guideline that ought to be used as a starting point. It is a framework that can be modified in accordance with each person’s particular set of circumstances and objectives rather than a rigid rule that must be adhered to exactly.

Let’s examine each asset class covered by the 60-30-10 rule in more detail:

Stocks: Stocks, also referred to as equities, stand for ownership in an organization. You become a shareholder and are entitled to a share of the company’s assets and profits when you invest in stocks. Over the long term, stocks have historically offered the highest returns among asset classes, but they also carry higher risk and volatility. The reason for this is that stocks are susceptible to changes in the market, the state of the economy, and company-specific variables like management shifts or pressure from regulators. As a result, the stock market frequently experiences significant fluctuations in price over relatively short periods of time as a result.

Bonds: Debt securities issued by governments or corporations. When you buy bonds, you’re essentially giving the issuer a loan in return for a steady stream of income. Because they offer a fixed income stream and are typically less impacted by changes in the market, bonds are generally thought to be less risky than stocks. On the other hand, over the long run, bonds also yield lower returns than stocks. This is because bonds have a fixed income stream, which means it doesn’t increase in line with rising business profits or an expanding economy.

Cash or low-risk investment: Savings accounts, money market funds, and short-term government bonds are examples of investments that fall under the category of cash or low-risk investment. These investments help a portfolio maintain stability and liquidity and can be used as a safety net in case of market declines. Although cash and low-risk investments typically offer lower returns than stocks or bonds, they also carry lower risk. They are a good choice for investors who want to protect their capital or have a short investment horizon.

When determining the appropriate asset allocation for a portfolio, it’s important to consider a few key factors:

Risk tolerance: This is the level of risk that a person is willing to accept when making investments. While some investors prefer to limit their risk exposure, others are comfortable with a higher level of risk in exchange for potentially higher returns.

Investment objectives: These include elements like the anticipated time horizon for the investment, the available funding, and the desired rate of return.

Diversification: To lower risk, investing in a range of asset classes is the practice of diversification. You might be able to lessen the effect of market volatility on your overall returns by diversifying your portfolio.

As a general principle, the 60-30-10 rule of investing can be used as a place to start when allocating assets. According to this, a portfolio should consist of 60% stocks, 30% bonds, and 10% cash or other low-risk investments. However, it’s important to consider individual factors such as risk tolerance, investment goals, and diversification when determining the appropriate asset allocation for a portfolio.

For whom is the 60 30 10 rule most suitable?

A budgeting rule known as the 60/30/10 rule can help you divide your income into three categories: necessities, lifestyle costs, and financial goals. According to this budgeting principle, you should allocate 60% of your income to necessities, 30% to lifestyle costs, and 10% to financial goals.

The monthly costs you must incur to meet your basic needs, such as housing, utilities, food, transportation, and insurance, are referred to as essential expenses. Since they are necessary for your daily existence, these costs should be your top priority. It is advised that you limit these expenses to no more than 60% of your income.

Lifestyle expenses are all the extra money you spend on things like hobbies, entertainment, personal care, and other non-essentials that aren’t necessary for your daily needs. Although it’s important to enjoy life and spend money on things that make you happy, it’s advised to keep this spending to no more than 30% of your income.

Financial goals are the funds you set aside to create a solid financial foundation for the future, such as setting aside money for an emergency fund, paying off debt, making investments, and saving for retirement. It is advised that you set aside at least 10% of your income for your financial goals because this area is crucial for your long-term financial security.

It’s crucial to keep in mind that the 60/30/10 budgeting rule is merely a suggestion, and your actual spending may vary depending on your unique situation. Depending on your level of income, your expenses, and your financial objectives, you might need to adjust the percentages. The secret is to find a budgeting strategy that works for you and enables you to effectively manage your finances.

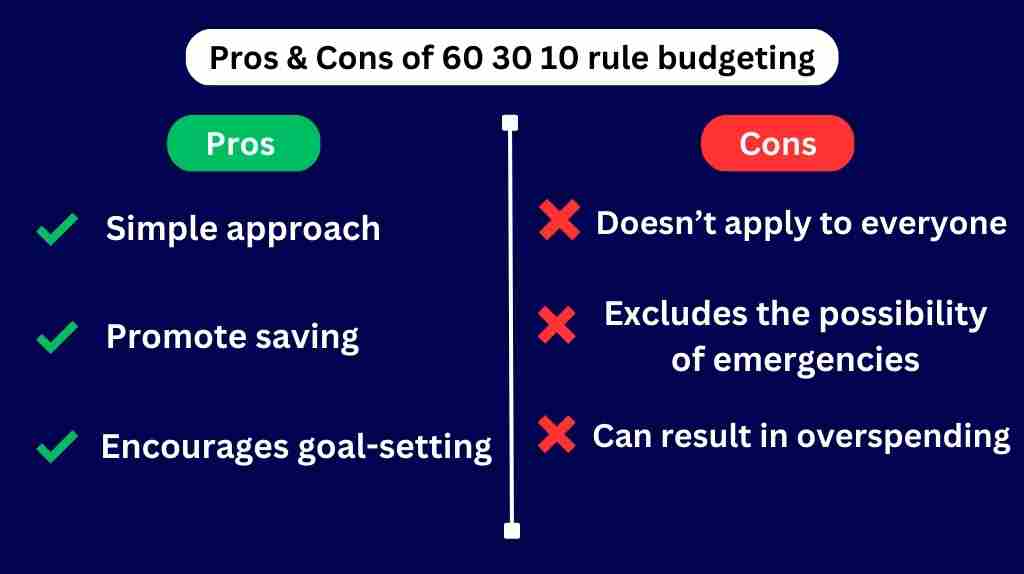

Pros & cons of 60 30 10 rule budget

A well-liked budgeting technique that can be used to assist people and households in allocating their income effectively is the 60-30-10 rule. The benefits and drawbacks of adhering to the 60-30-10 rule are as follows:

| Pros | Cons |

|---|---|

| Simplicity: It is simple to comprehend and apply the 60-30-10 rule. It is a fantastic option for those who are new to budgeting because it doesn’t call for any intricate calculations or budgeting software. | Possibly not suitable for all: Everyone may not be able to follow the 60-30-10 rule, especially those with extremely high or low incomes, significant debt, or other financial commitments. |

| Flexibility: People can modify their budget in accordance with their particular needs and circumstances thanks to the 60-30-10 rule’s flexibility. It can be modified to suit various income levels, living arrangements, and monetary objectives. | Not sufficiently specific: As a result of the 60-30-10 rule’s lack of specific instructions on how to divide funds among each category, there is some room for interpretation. |

| Encourages saving: The 10% savings category in the 60-30-10 rule encourages people to save money regularly, which can help them build an emergency fund, save for a down payment on a home, or plan for retirement. | Doesn’t account for debt: The 60-30-10 rule doesn’t take debt repayment into account, which can be a significant expense for many people. This implies that individuals may need to change their budget to account for debt payments. |

| Help prioritize saving: Help people prioritize their spending by allocating 60% of their income to necessities, 30% to wants, and 10% to savings. This is known as the 60-30-10 rule. This can assist people in making better financial decisions and preventing overspending. | Not a universally applicable fix: The 60-30-10 rule is not a one-size-fits-all solution, but it can be a useful place to start when creating a budget. Depending on their particular situation and financial objectives, people might need to adjust. Overall, many people may find the 60-30-10 rule to be a useful budgeting strategy. It encourages regular savings and is straightforward and adaptable. To meet specific needs and conditions, it’s crucial to be aware of its limitations and make the necessary adjustments. |

What if the 60 30 10 rule budget fails?

The first thing you should do if you find that the 60-30-10 rule budget is not working for you is to look at your spending habits and identify the areas where you are overspending. If you have a lot of debt, you might need to change the percentages of your budget and give debt repayment more importance. If you are having trouble managing your finances, another option is to seek professional guidance from a financial planner or advisor. Individuals can effectively manage their finances, maintain a comfortable standard of living, and work toward achieving their financial goals with the use of sound budgeting techniques.

Alternative budgeting method

The 70 20 10 rule budget

According to this rule, the percentage is categorized as follows:

- 70% for necessities

- 20% for savings

- 10% for leisure/miscellaneous expenses

A great way to begin managing your finances and achieving your financial objectives is by using the 70 20 10 rule. Putting your expenses in order will help you allocate your income in a way that works for you. It goes without saying that every person’s financial situation is unique, so you should modify the percentage to suit your own circumstances. You can work to achieve long-term success and financial stability by adhering to this rule.

The 50 30 20 rule budget

We breakdown this into three categories as follows:

- 50% for essential expenses

- 30% for wants

- 20% for savings

It might be necessary to make some lifestyle and spending habit changes in order to put the 50 30 20 rule of budgeting into practice, but it’s a great way to start getting control of your money.

The 80 20 rule budget

Here, 20% of your income must be set aside for savings, and only 80% of your income can be spent. This method enables you to prioritize saving and is simple and adaptable.

- 80% for all expenses

- 20% for savings

You can achieve your financial objectives by concentrating on the 20% of your budget that accounts for 80% of your expenses.

The 60 20 20 rule budget

Budgeting according to the 60 20 20 rule is very simple and adaptable. It offers a precise framework for handling your finances. You can easily see where your money is going by breaking it up into three categories and making any necessary adjustments. The three categories include

- 60% for essentials

- 20% toward saving

- 20% towards the financial goal

Applying this rule will help you prioritize your financial objectives, lay a strong financial foundation, and live a fulfilling life without going over budget.

You’ll be well on your way to achieving financial success if you maintain your self-control and dedication to your budget. Visit for more information on the 60 20 20

The 60 40 rule budget

A budget based on the 60-40 rule is a great tool for achieving financial balance. But it requires commitment and discipline, just like any other budgeting technique. This method is divided into two categories:

- 60% for fixed expenses

- 40% for variable expenses

You’ll be well on your way to achieving financial success if you maintain your self-control and dedication to your budget.

The 30 30 30 10 rule budget

The 30 30 30 10 rule budget is a straightforward budgeting technique that assists people in dividing their income into four categories, which are as follows:

- 30% for needs

- 30% for wants

- 30% for savings

- 10% for investing

Keep in mind that finding the right budgeting strategy for you may take some time.

Visit for more information on the 30 30 30 10

Conclusion

The 60-30-10 rule can also be applied to budgeting, particularly for personal finances. In this case, the rule suggests that 60% of your income should be allocated for necessary expenses such as rent or mortgage, utilities, food, and transportation. 30% of your income should be allocated for discretionary spending such as entertainment, dining out, and hobbies. The remaining 10% should be allocated for savings and investments such as retirement accounts, emergency funds, and stocks or bonds. By guaranteeing that essential costs are met while also allowing for some discretionary spending and savings, this rule can assist people in developing a balanced and long-term budget. This rule is merely a guideline that can be modified to fit specific priorities and situations. To make sure that you are reaching and maintaining your financial objectives, it is crucial to regularly review and modify your budget as needed.

Design, budgeting, and time management are just a few areas in which the 60-30-10 rule can be useful as a general rule of thumb. It offers a clear framework for establishing harmony and balance throughout various facets of our lives. We can make sure that we are meeting our needs and priorities without ignoring other crucial areas by dividing up the available resources among the various categories.

The 60-30-10 rule can be a helpful starting point for developing a budget that balances necessary expenses, discretionary spending, and savings and investments in terms of personal finance. It offers a precise framework for handling your finances and can aid in your decision-making regarding how to divide up your resources.

The 60-30-10 rule may or may not be useful in real life, depending on the circumstances and preferences of each person. It can be modified to fit different objectives and priorities because it is a guideline rather than a rigid rule. However, the 60-30-10 rule can be a useful tool for developing a more balanced and fulfilling life because it offers a clear and simple framework for balancing various aspects of life.

FAQs

The 60-30-10 rule is a straightforward and adaptable budgeting technique that can assist you in prioritizing your spending and ensuring that you are not spending on items that are not absolutely necessary.

If your take-home pay is 100k, then you can divide it into three categories:

60% for savings

30% for needs

10% for wants

i)Establish a budget.

ii) Boost your income

iii) settle the debt

iv) Cut back on spending

v) Establish an emergency fund

Take advantage of our article on finaap.com if you need assistance setting up a budget that works for you. You’ll find tips that will help you create a budget that works with your goals and resources. Visit finaap.com for more amazing money advice.

Thank you so much for reading the article, hope you enjoyed.