Making financial decisions based on a budget could lead to rigidity and inflexibility. The budget may need to be adjusted in case of unforeseen costs or changes in circumstances. This system’s rigidity may cause missed opportunities or financial hardships in the event of unforeseen costs or urgent situations. Furthermore, if people disagree about what expenses should come first in a household or organization, budgeting can lead to unneeded stress and tension. Additionally, some people may become overly preoccupied with their budgets and neglect other crucial components of their financial planning, such as investing in their education or saving for retirement.

What is budgeting?

Budgeting is the process of creating a plan for how to allocate financial resources over a specified period of time, typically a month, quarter, or year. This process involves estimating expected income and expenses and making decisions about how to allocate resources to achieve financial goals.

A budget typically includes a detailed breakdown of income sources, fixed and variable expenses, debt payments, and savings goals. By creating a budget, individuals or organizations can track their financial progress, identify areas where they can cut costs, and plan for future expenses. Budgeting can help individuals and organizations make informed financial decisions and ensure that they are living within their means.

Benefits of budgeting

Numerous advantages of budgeting include:

- Maintains your focus on your financial objective: Creating a budget enables you to plan how you will allocate your funds in order to meet your financial objectives. You can make sure that you are moving closer to your goals by adhering to your budget.

- Enables you to save money: By using a budget, you can find areas where you are overspending and make changes to cut costs. Long-term financial savings may result from this.

- Reduce anxiety: Having a budget gives you a clear understanding of what you can and cannot afford. As a result, you won’t have to worry as much about whether you have enough money to pay for your expenses.

- Enhances financial management abilities: Budgeting can assist you in improving your financial management abilities, including keeping track of your spending, establishing financial goals, and making future plans.

- Helps you stay out of debt: Using a budget to manage your finances will help you stay out of debt by controlling your spending.

- Makes it possible for you to make wise financial decisions: Making financially sound decisions is possible when you have a budget. You can anticipate how your decisions will affect your overall financial situation and make changes as necessary.

In general, creating a budget can help you gain control over your money, lessen stress, and reach your financial objectives.

Disadvantages of budgeting

There are several disadvantages of budgeting, including:

- Time-consuming: Setting up and maintaining a budget can take a lot of effort, especially for large organizations with intricate financial systems.

- Rigidity: Once established, budgets may be impermeable and challenging to alter. This could be a problem when unanticipated events or changing circumstances call for a different course of action.

- Unrealistic expectation: Budgets are frequently based on assumptions and projections, which may be exaggerated or incorrect. In the event that the budget goals are not reached, this may result in frustration and disappointment.

- Inaccurate data: Budgets rely on accurate financial data, and if this data is incorrect, it can lead to poor decision-making and inaccurate budgeting.

- Conflict & tension: Budgets can lead to disagreements and tense situations between various departments or people whose priorities and interests differ.

- Focus on short-term objectives: Budgets are frequently made with the intention of achieving immediate financial objectives, which can result in the neglect of long-term objectives and strategic planning.

- Lack of flexibility: Budgets can stifle innovation and creativity by discouraging investment in fresh concepts or projects that might not be financially feasible.

All of the following are components of the master budget except

This is a comprehensive financial plan for a company that covers all aspects of its operations over a given period of time, typically a year. An integrated budget plan includes several individual budgets, such as sales budgets, production budgets, cash budgets, and budgeted income statements.

The following are all components of the master budget since they are all individual budgets that are integrated into the master budget:

- Sales budget

- Production budget

- Cash Budget

- Budgeted income statement

Therefore, none of the components of the master budget are excluded.

A rolling budget is updated on a basis

When using a rolling budget, the earliest time period is removed, and a new period is added at the end of the budget. This is done on a regular basis, typically monthly or quarterly. As a result, the budget is consistently updated to reflect the most recent information and assumptions, and it always refers to a particular period of time in the future, like the following 12 months.

Rolling budgeting entails creating a budget for an ongoing period of time as opposed to traditional budgeting, which typically entails creating a budget for a fixed time period, such as a fiscal year, and updating it only once a year. With a rolling budget, businesses are better able to respond to changes in their environment, such as fluctuations in sales or shifting market conditions. In order to make better decisions and keep moving in the direction of their financial goals, they can adjust their spending and revenue projections based on the most recent information.

What is the budgetary control process?

Budgetary control is a method of keeping track of, evaluating, and making changes to a company’s financial performance in relation to set goals and budgets. The process entails the creation of a detailed financial plan or budget that details the organization’s anticipated revenues, expenses, and capital expenditures over a set time period.

In general, the budgetary control process assists organizations in ensuring that their financial resources are allocated effectively and efficiently and that they will continue to be stable and viable financially in the long run.

Steps in the correct order as they relate to the budgetary control process

Typically, the following steps are included in the budgetary control process:

- Setting budgets: Based on historical data and anticipated future performance, budgets are created for each department or activity within the organization.

- Communication & approval: The management and the appropriate stakeholders are informed of the budget.

- Budget execution: The organization carries out the budget, closely monitoring and controlling all expenditures and revenue-generating activities.

- Evaluation of performance: Variances are found, and their causes are examined by comparing the actual financial performance to the budget.

- Corrective action: In light of the analysis, corrective action might be taken to deal with the discrepancies and make sure that the organization stays on course to meet its financial objectives.

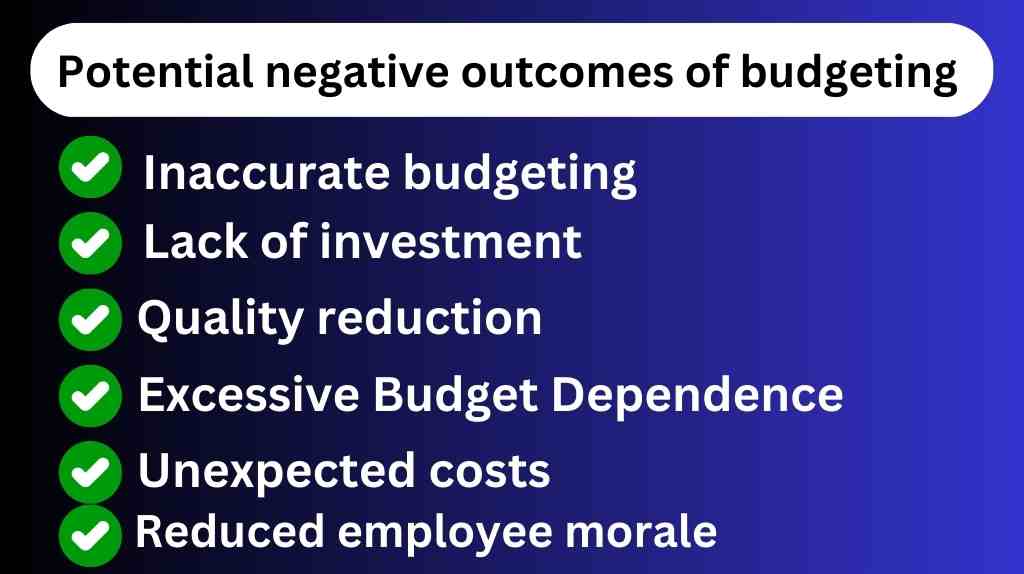

Potential negative outcomes of budgeting

Inaccurate budgeting: Budgeting that is inaccurate can result in financial difficulties and missed opportunities if it is not based on accurate data or if the business environment unexpectedly changes.

Lack of investment: Budgeting may result in a lack of funding for important initiatives like employee training, marketing, and research and development, which can stifle new ideas and business expansion.

Quality reduction: Since the goal of budgeting is to maximize the quality rather than minimize costs, quality may suffer as a result. Lower sales and lower customer satisfaction may follow from this.

Excessive Budget Dependence: Excessive budget dependence can result in a lack of flexibility and agility in responding to changes in the business environment. Businesses may find it challenging to adjust to shifting market conditions or seize new opportunities as a result.

Unexpected costs: Unexpected costs, like equipment failures or legal troubles, can push a company over budget and put it in financial trouble.

Reduced employee morale: If workers believe their pay is unfair or that their departments are being cut, their morale may drop, which may result in lower productivity and a higher turnover rate.

An insufficient overview: Budgeting may provide an incomplete picture of a company’s financial situation because it may not account for things like cash flow or debt. Financial problems may result if the company is unable to control its cash flow or pay its debts.

Resource allocation that is inefficient: Budgeting may result in the allocation of resources that do not maximize return on investment. As a result, opportunities might be lost, and profits might decline.

What is a negative budget?

When a person or organization has a deficit or shortfall because their expenses are greater than their income or revenue, this is referred to as having a negative net worth or negative budget.

In order to balance their budget, they may need to borrow money or cut expenses because they are spending more than they are earning. While in business or government, this could result in financial instability or even bankruptcy; in personal finance, debt and money problems could result. In personal finance, this can lead to debt and financial difficulties, while in business or government, it can lead to financial instability or even bankruptcy. Overall, a negative budget is a situation that should be avoided, and steps should be taken to address it as soon as possible.

What is the effect of a negative budget balance on the country?

A country’s government incurs a negative budget balance, also referred to as a budget deficit, when it spends more money than it brings in. This could impact the nation in a number of ways, including:

A rise in the nation’s debt: A government that has a budget deficit must borrow money to make up the difference. This results in a rise in the nation’s debt, which can eventually become unmanageable if it increases too much.

Payment of interests: The government is required to make larger interest payments to lenders as the national debt rises. As a result, debt servicing may receive more funding from the budget than spending on crucial areas like infrastructure, healthcare, and education.

Inflation: A budget deficit can occasionally cause inflation if the government uses the central bank to finance its spending. As a result, the country’s currency may depreciate, and imported goods may become more expensive.

Reduced confidence: A significant budget deficit may make investors less inclined to put money into a nation’s economy and government, which could have an adverse effect on economic growth.

A country’s economic stability and long-term growth prospects can generally suffer significantly from a negative budget balance.

The capital expenditures budget reports expected

An overview of the company’s planned investments in long-term assets that are anticipated to produce income or offer other benefits over a number of years is typically included in a capital expenditures budget report. The report could contain the following details:

Summary of capital expenditures: A high-level overview of the total amount of money allotted for capital expenditures during the budget period is provided in the capital expenditures summary.

Breakdown by category: A breakdown of capital expenditures according to a category, such as land, technology, buildings, and equipment. Stakeholders may better understand the company’s resource allocation as a result.

Project information: A list of specific projects that are outlined in the capital expenditures budget, as well as information on each one, such as the anticipated costs, schedule, and potential advantages.

Funding sources: Details on how the capital expenditures will be paid for, such as cash reserves, borrowing, or equity financing.

Return on investments: A study of the anticipated ROI (return on investment) for each project, taking into account expected future income or cost savings.

Risks and challenges: A review of the risks and difficulties that each project may encounter, along with a strategy to reduce those risks.

Updates on progress: Ongoing reports on how each project is doing, including any adjustments to the budget or schedule.

Overall, a capital expenditures budget report is an important tool for communicating the company’s investment strategy and long-term plans to stakeholders, including investors, lenders, and employees.

Read more capital budgeting methods

Conclusion

Planning and keeping track of income and expenses are part of the popular financial management tool known as budgeting. While budgeting can be a helpful tool for achieving financial goals and ensuring responsible spending, there are also drawbacks.

The fact that budgeting can be restrictive and impose financial restrictions is one of the most significant adverse effects. People risk missing out on opportunities or experiences that could enhance their quality of life when they place an excessive amount of emphasis on sticking to a budget. Depressive thoughts or feelings of resentment may result from this.

Budgeting may also result in some overspending in certain areas, which is another possible drawback. When people make a budget, they might have irrational expectations about how much they can spend in particular categories, which can cause them to overspend and go over their budget. They may experience financial stress as a result and be in a worse financial situation than they were before they started budgeting.

As couples may have different priorities and financial goals, budgeting can also cause conflict in relationships. Budgeting can lead to tension and arguments that could harm the relationship if it is not done carefully.

Last but not least, budgeting can be time-consuming and tedious because it calls for people to continuously monitor their spending and make adjustments to their budgets. For those who have demanding schedules or complicated financial situations, this may be especially difficult.

In conclusion, even though budgeting can be a useful tool for handling money, it’s important to be aware of any potential drawbacks. People can make wise decisions about how to manage their finances and reach their financial objectives by being aware of these potential drawbacks.

FAQs

Making and following a budget can be stressful and worrying, especially if you’re having trouble making ends meet or reaching your financial objectives. Budgets frequently oversimplify complicated financial circumstances, such as investment choices or long-term savings objectives. This may result in making poor decisions and passing up opportunities.

Budgeting has some drawbacks, one of which is the potential for rigidity and inflexibility. Budgets are typically developed based on future projections and assumptions, which may or may not be accurate. The budget might no longer be applicable or useful if unanticipated events take place, like an abrupt rise in expenses or a drop in income.

Underestimating expenses, failing to track expenses, forgetting to include savings, and overestimating income are the biggest budgeting mistakes to avoid. To make sure that your finances are in order and that you can meet your financial goals, it is crucial to avoid these common budgeting errors.

A more adaptive and flexible approach to managing organizations, particularly in relation to financial planning and control, is advocated by the management philosophy known as “Beyond Budgeting.” This strategy may have a lot of potential advantages, but there may also be some drawbacks. Here are a few:

Inability to predict

Absence of responsibility

opposition to change

Possibility of higher risk

Budget tracking is difficult.

The following are the three consequences of not budgeting

Overspending

Lack of saving

Missed opportunities