Setting financial goals is usually where a long-term financial plan starts. This entails determining your short- and long-term financial goals, such as purchasing a home, setting aside money for retirement, or paying for your children’s education. In order to achieve your goals, you must first establish a realistic and workable plan. A thorough budget, a savings strategy, investment tactics, and a strategy for handling debt management should all be part of this plan. To make sure you are on track to achieve your financial goals in the long run, it is crucial to regularly review and modify your plan as necessary.

What is a financial plan called?

An organization’s or an individual’s financial goals, strategies, and actions to reach those goals are described in detail in a financial plan, which is a comprehensive document. It acts as a road map for managing money and establishing financial stability and security. It is frequently referred to as a budget or personal financial plan.

An individual’s or organization’s income, expenses, debts, investments, and savings are typically listed in a financial plan. Achieving financial objectives and risk management strategies are also included, along with projections for future income and expenses.

An expert in areas like budgeting, investing, retirement planning, and tax management, such as a financial advisor or planner, is typically used to create a financial plan. The financial planner collaborates closely with the person or business to learn about their financial situation and develop a plan that is customized to meet their unique needs and objectives.

What is a long-term financial plan?

The objectives that an individual or organization sets for their financial future, typically spanning over several years or even decades, are referred to as long-term financial goals. These objectives typically center on increasing wealth, obtaining financial stability, and ensuring a comfortable retirement.

Long-term financial goals may vary from person to person depending on their circumstances, way of life, and financial objectives. Long-term financial objectives might take the following forms:

- establishing an emergency fund to pay for unforeseen costs

- making down payment savings

- To ensure financial security in old age, one should invest in retirement funds.

- paying off debts like student loans or mortgages

- To achieve long-term financial growth, create a diversified investment portfolio.

- Putting money aside for your kids’ education or other important life events

Overall, achieving long-term financial objectives necessitates preparation, self-control, and a dedication to making financial decisions that are in line with those objectives. To make sure you continue on the right path in pursuit of your long-term financial objectives, it is crucial to set reasonable and doable goals, make a budget, and regularly assess your progress.

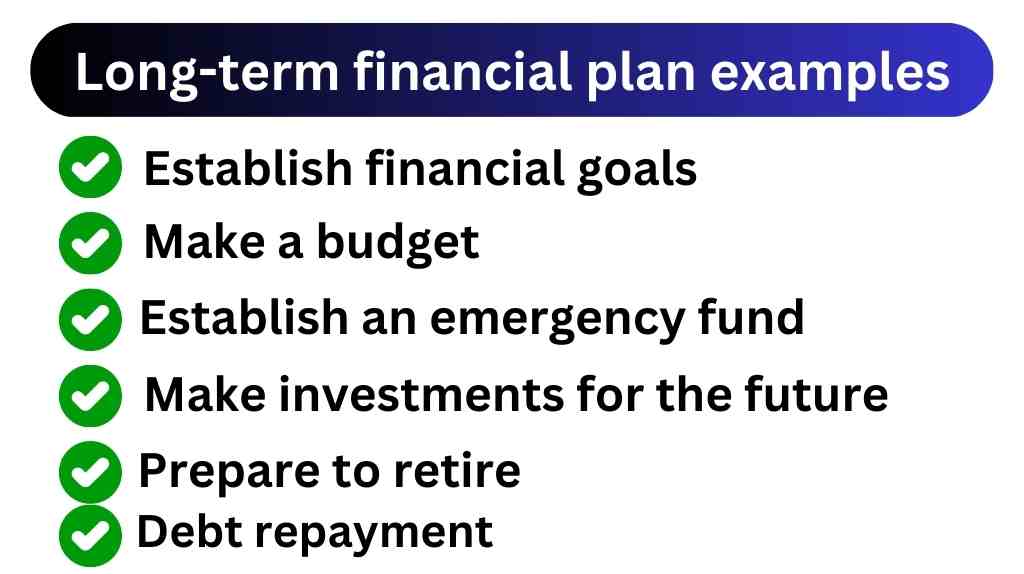

Long-term financial plan examples

In order to help people achieve their desired financial outcomes over the course of several years or decades, long-term financial plans typically include a variety of financial goals and strategies. Here is an illustration of a long-term financial plan:

Establish financial goals:

To start, decide what your long-term financial objectives are, such as saving for retirement, making a down payment for a house, or paying off debt. Create SMART (short-term, measurable, achievable, relevant, and time-bound) objectives.

Make a budget:

After taking into account your current spending habits, create a budget that is in line with your financial goals. Don’t forget to budget enough money to achieve your long-term financial goals.

Establish an emergency fund:

Put money aside for unforeseen emergencies like job loss, unforeseen medical costs, or home repairs. It is advised to keep an emergency fund with enough money in it to last at least six months.

Make investments for the future:

Think about purchasing stocks, bonds, mutual funds, or other investment vehicles that have a history of producing returns. The best investment opportunities for your objectives can be found by consulting a financial advisor.

Prepare to retire:

Set up a retirement savings plan and think about making contributions to a 401(k), IRA, or other retirement savings plan as you prepare for retirement. Make necessary adjustments to your budget based on the amount you will need to save in order to reach your retirement goals.

Debt repayment:

To stop yourself from taking on more debt and to raise your credit score, pay off high-interest debt first, like credit card balances.

Examine and modify your plan:

On a regular basis, evaluate your long-term financial strategy and make as necessary based on changes in your financial situation or goals.

Always keep in mind that a long-term financial plan needs to be flexible and adaptable to changes in your financial situation and personal situation. You can take charge of your financial future and realize your long-term financial goals by developing a comprehensive plan that is doable.

What is a short-term financial plan?

An individual’s or a company’s financial goals, strategies, and resources for achieving those goals within the given timeframe are outlined in a short-term financial plan, which typically covers a period of one year or less. It typically focuses on controlling cash flow, making sure there is enough liquidity, and taking care of immediate financial obligations like paying bills, taxes, and other outgoings.

A budget, a cash flow statement, and a plan for handling debt and credit are all possible components of a short-term financial plan. Additionally, it might contain methods for boosting earnings, cutting costs, and saving money. To keep the goals relevant and reachable, the plan needs to be reviewed and updated frequently to account for changes in the situation.

A short-term financial plan, in general, assists people and businesses in maintaining their financial discipline, prioritizing their expenses, and making better short-term financial decisions.

Short-term financial plan examples

Following are some instances of short-term financial objectives:

Vacation savings:

If you have a trip scheduled soon, saving money for it can serve as a short-term financial objective.

Saving up for a new appliance or electronic device:

This saving can serve as a short-term financial objective if you need to replace a broken or out-of-date item.

Renovation of the home:

Renovating a space or funding immediate home repairs may be a financial priority.

Small loan repayment:

Paying off a smaller loan with a brief repayment period, like a personal loan, can be a short-term financial objective.

Financial Planning Short-term and Long-term Calculator

Result:

-

The cash budget is most critical for

Businesses that operate with a tight cash flow or have few cash reserves need the cash budget the most. This includes small businesses, new ventures, and companies whose cash flow is highly seasonal or volatile.

A financial tool called a cash budget is used to forecast cash inflows and outflows for a given time frame, usually a month, quarter, or year. The cash budget can assist business owners and managers in making informed choices about when to invest in new projects or assets, how much to borrow, and when to postpone payments or reduce expenses by forecasting the company’s cash position.

A cash budget is crucial for businesses with small cash reserves to make sure they have enough money to cover operating costs, make timely payments to their creditors, and stay out of trouble with expensive overdraft fees or other financial penalties. These companies can prevent serious cash flow problems from occurring by closely monitoring their cash position. This will allow them to spot potential problems early on and take preventative action.

All things considered, the cash budget is a vital tool for companies of all sizes to manage their cash flow effectively and make wise financial decisions.

Most firms, when planning for growth, focus on

Most businesses tend to concentrate on several important areas when making growth plans:

New Market Expansion: Businesses can also grow by entering new markets. Reach a larger customer base. This entails spotting new opportunities and venturing into uncharted territory.

Sales growth: Increasing sales is one of the main strategies used by businesses to expand. This can be done in a number of ways, including stepping up marketing efforts, broadening the product offering, and entering untapped markets.

Investing in research and development: Innovation is a key engine for business growth. Companies can create new products and services, enhance current ones, and gain an advantage over rivals by making investments in research and development.

Increasing operational effectiveness: By increasing their operational effectiveness, businesses can grow. This entails improving productivity while also streamlining business processes and cutting waste. By doing this, they can lower expenses, raise profit margins, and improve their level of competition generally.

Sales growth: Increasing sales is one of the main strategies used by businesses to expand. This can be done in a number of ways, including stepping up marketing efforts, broadening the product offering, and entering untapped markets.

Purchasing Rival or Complementary Companies: Mergers and acquisitions can also be a growth strategy for businesses. Companies can increase their product offerings, customer bases, and geographic reach by acquiring rivals or complementary businesses.

The key input required to build a cash budget is

Thorough knowledge of the company’s cash inflows and outflows over a given time period is the main component needed to build a cash budget. This entails forecasting the amount of money that will be paid to suppliers, employees, and other expenses, as well as the amount of money that will be received from customers and other sources. Some of the important components that could be needed to create a cash budget include the following:

Sales projections: These are estimates of how much revenue the company will bring in over a certain time period. The amount of money that will be received from customers is determined by this, making it a crucial input for the cash budget.

Accounts receivable: This term describes the sum of money that clients owe the business for unpaid invoices. In order to forecast cash inflows from sales, it is crucial to understand the level of accounts receivable.

Debt service: This is the term used to describe the payments that the business must make to pay off its debts, including principal and interest. Planning cash outflows requires an understanding of the debt service ratio.

Capital expenses: These are investments made in permanent assets like machinery or real estate. When estimating cash outflows, it’s crucial to understand the magnitude of capital expenditures.

Costs of operation: These are the costs incurred by the business to operate, including rent, utilities, and employee salaries. In order to forecast cash outflows, it is crucial to comprehend the scope of operating costs.

Accounts payable: This term describes the sum of money that the business owes to suppliers and vendors for goods or services purchased. Planning cash outflows from purchases requires an understanding of the level of accounts payable.

A cash budget that forecasts the company’s cash inflows and outflows over a given time period can be created by analyzing these inputs. Informed decisions about investments and spending can be made by the business as a result of being able to effectively manage its cash flow.

Required total financing figures in a cash budget

For a specific time period, usually a month, quarter, or year, a cash budget typically includes projections of all cash inflows and outflows. The total cash outflows anticipated for the period will determine the required total financing amounts in a cash budget.

Financing will be needed to make up the difference if the total cash outflows are greater than the total cash inflows. This funding may originate from a number of different sources, including loans, credit lines, and equity investments.

You would need to calculate the total cash outflows for the budget period and deduct the total cash inflows to get the required total financing figures. If the outcome is negative, that is how much money will need to be raised to make up the difference.

For instance, if a company anticipates total quarterly cash outflows of $100,000 and total quarterly cash inflows of $80,000, then the total amount of financing needed to make up the $20,000 shortfall would be $20,000.

Euro debt is the term used to designate

The collective debt of the European nations that use the euro as their currency is referred to as “euro debt.” The European Union members such as Germany, France, Italy, Spain, and others that have made the euro their official currency are included in this.

In addition, the term “euro debt” may be used to describe the issuance of debt securities in the euro by businesses, financial institutions, or governments outside the eurozone that are later held by investors in the eurozone.

Because of the interdependence of the European economies and the requirement for coordinated fiscal policies and debt management throughout the eurozone, the concept of euro debt is crucial. It also draws attention to the dangers that come with high levels of national debt, which can jeopardize the stability of the entire eurozone.

Conclusion

To reach your financial objectives and safeguard your financial future, you must have a long-term financial plan. You can increase your wealth, increase your financial stability, and be ready for unforeseen expenses or life events by setting specific financial goals, making a budget, investing in a diversified portfolio, and routinely reviewing and adjusting your plan. It’s crucial to keep in mind that developing a long-term financial plan requires persistence, self-control, and dedication and that there is never a bad time to begin. You can achieve your long-term financial objectives and have peace of mind when you have a sound financial plan in place.

FAQs

Long-term financial goals are the aspirations that a person or organization has for their financial future, usually spanning several years or even decades. These goals frequently focus on boosting wealth, achieving financial stability, and securing a comfortable retirement.

A sales forecast is typically the first step in long-term financial planning because it serves as the basis for estimating future revenue and cash flow, both of which are essential elements of any financial plan. With the aid of sales forecasts, businesses can plan ahead for how much they will sell, how much money they will make, and how much cash they will have to invest in new business ventures or pay their debts.

Setting up specific, attainable financial goals is typically the first step in financial planning. This entails deciding what you hope to accomplish with your money, such as funding a child’s education, buying a home, paying off debt, or saving for retirement. Once your objectives are clear, you can begin to formulate a strategy to achieve them.

A long-term plan’s duration can vary depending on the situation and the goal of the plan. A long-term plan typically refers to a strategic plan that spans three to five years, or even longer in some cases, up to 10 or 20 years.

Obtaining funds that will be repaid over a period longer than a year is referred to as long-term financing. Large capital purchases, like those in real estate, infrastructure, or equipment, are frequently financed with long-term financing.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?